No products in the cart.

Investment, Stock Market

Life Insurance Myths: 7 Dynamic Tips for Comparing Facts in the Philippines

Life Insurance Myths: 7 Dynamic Tips for Comparing Facts in the Philippines

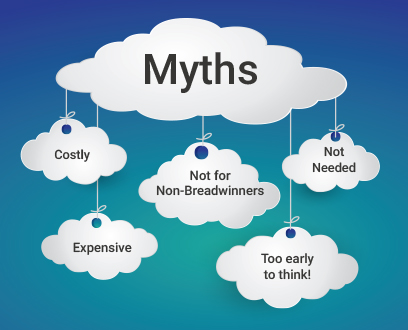

Life insurance is an essential financial tool that provides security and peace of mind for individuals and their families. However, misconceptions and myths about life insurance often lead to confusion, discouraging many people from obtaining proper coverage. This guide addresses common myths and reveals the facts to help you make informed decisions about life insurance.

Myth 1: Life Insurance is Only for the Elderly

Fact: Life Insurance Benefits All Age Groups

Life insurance is not just for seniors. In fact, purchasing a policy at a younger age has significant advantages:

- Lower premiums: Younger individuals typically receive more affordable rates compared to older applicants.

- Long-term financial security: Buying early ensures lifelong protection for family members.

- Investment potential: Certain policies, like whole life insurance, can accumulate cash value over time.

For young adults, life insurance is a proactive financial decision that guarantees affordable rates and long-term stability.

Myth 2: Only Breadwinners Need Life Insurance

Fact: Life Insurance is Beneficial for Anyone Contributing to a Household

While primary income earners need coverage, life insurance is also essential for non-working family members, such as:

- Stay-at-home parents: They provide invaluable services like childcare and household management, which would be costly to replace.

- Caregivers: Those who support elderly or disabled family members would leave financial burdens in their absence.

- Individuals with significant debt: Life insurance can cover outstanding loans and prevent financial strain on loved ones.

Regardless of employment status, life insurance ensures financial protection for anyone contributing to a household’s well-being.

Myth 3: Life Insurance is Too Expensive

Fact: Life Insurance Can Be Affordable

Contrary to popular belief, life insurance is often more affordable than people assume. Factors that influence cost include:

- Age and health: Younger and healthier individuals qualify for lower premiums.

- Policy type: Term life insurance is a cost-effective option, offering coverage for a fixed period at affordable rates.

- Flexible coverage: Policies can be tailored to fit different budgets and financial needs.

Instead of viewing life insurance as an expense, consider it an investment in financial security that offers long-term value.

Myth 4: Employer-Provided Life Insurance is Sufficient

Fact: Employer Coverage May Not Be Enough

While many employers offer life insurance, relying solely on workplace coverage may be risky because:

- Limited benefits: Employer-sponsored policies often provide minimal coverage, which may not be sufficient for your family’s needs.

- Job dependency: If you change jobs or retire, you may lose your coverage.

- Lack of customization: Employer plans usually don’t allow adjustments based on personal financial goals.

A personal life insurance policy ensures continuous and adequate protection, regardless of employment status.

Myth 5: You Don’t Need Life Insurance if You’re Single

Fact: Life Insurance Provides Key Benefits Even for Singles

Life insurance is valuable even if you don’t have dependents because it can:

- Cover final expenses: Funerals, medical bills, and debts can be a burden on family members.

- Pay off outstanding loans: Private student loans and personal debts do not disappear after death.

- Lock in low rates for the future: Purchasing a policy early in life secures affordable premiums for later years.

Even if you’re single today, life insurance ensures financial stability for your future spouse, children, or beneficiaries.

Myth 6: I’m Too Young to Need Life Insurance

Fact: Buying Early Offers Long-Term Advantages

Age is a crucial factor in determining life insurance premiums. The younger and healthier you are, the lower your premiums will be. Benefits of buying early include:

- Affordable premiums for life: Locking in a low rate ensures long-term savings.

- Guaranteed coverage: If health conditions develop later, you’re already covered.

- Financial protection for future dependents: Even if you don’t have dependents now, you may in the future.

Purchasing life insurance while young is a smart financial move that provides affordability and security for the future.

Myth 7: Life Insurance is Only for Death Benefits

Fact: Life Insurance Offers More Than Just a Payout

While the primary purpose of life insurance is to provide a death benefit, certain policies also offer living benefits, such as:

- Cash value accumulation: Whole life and universal life policies build cash value that can be withdrawn or borrowed against.

- Supplemental retirement income: Some policies provide a source of funds in later years.

- Critical illness benefits: Some plans allow early withdrawals for medical emergencies.

Life insurance is not just a safety net—it can also be a financial tool for wealth-building and security.

Conclusion: Separating Fact from Fiction

Life insurance is a vital component of financial planning, offering stability and protection for individuals and families. By debunking these common myths, we can better understand its true value and make informed decisions about our financial future.

Key Takeaways:

Life insurance is valuable for all ages—not just the elderly. Anyone contributing to a household’s well-being can benefit from life insurance. Life insurance is often more affordable than people think. Employer-sponsored coverage may not be enough. Even singles and young adults can benefit from life insurance. Life insurance offers living benefits beyond death coverage.

Take Action Today

Don’t let misinformation keep you from securing financial protection. Take the time to research, compare policies, and invest in the right life insurance plan to safeguard your future and protect your loved ones. Making a well-informed decision today can provide peace of mind for years to come.

READ MORE RELATED BLOGS!

READ MORE AND SHARE!

TSOK Chronicles: Unleashing Passion, Dedication, and Excellence in 2024

2023 Your Practical Wedding Guide

Investments and Finance Ultimate Guide

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia@gmail.com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.