No products in the cart.

Stock Market

The Role of Market Timing in Stock Investing: 5 Critical Insights for Philippine Investors

The Role of Market Timing in Stock Investing: 5 Critical Insights for Philippine Investors

Market timing is a controversial yet fascinating investment strategy that has captivated investors in the Philippine Stock Market for decades. While some view it as a potential path to extraordinary returns, others see it as a risky approach fraught with potential pitfalls. This comprehensive exploration will delve deep into the nuances of market timing, providing Philippine investors with a balanced and strategic perspective on this complex investment technique.

Understanding Market Timing: A Philippine Context

:max_bytes(150000):strip_icc()/GettyImages-171242305-849667ebeb494364b5644277eeb90463.jpg)

Market timing is an investment strategy where investors attempt to predict future market movements and make buying or selling decisions based on these predictions. In the Philippine Stock Market, also known as the Philippine Stock Exchange (PSE), this approach involves carefully analyzing economic indicators, company performances, global trends, and local market conditions to make strategic investment moves.

The Theoretical Framework

The core premise of market timing revolves around four key principles:

- Predicting market peaks and troughs

- Moving in and out of financial markets strategically

- Maximizing returns by avoiding potential downturns

- Capitalizing on potential growth opportunities

Historical Performance of Market Timing in the Philippine Stock Market

Empirical Evidence and Challenges

Historically, the Philippine Stock Market has demonstrated significant volatility. From the early 2000s to the present, investors have witnessed numerous market cycles, including:

- The global financial crisis of 2008

- The steady growth period from 2010-2015

- The impact of the COVID-19 pandemic in 2020

- The subsequent market recovery and digital transformation era

Research consistently shows that perfectly timing the market is exceptionally challenging. Studies suggest that even professional fund managers struggle to consistently predict market movements with high accuracy.

Key Strategies for Effective Market Timing in the Philippines

1. Economic Indicator Analysis

Successful market timing in the Philippine context requires a deep understanding of:

- Gross Domestic Product (GDP) trends

- Inflation rates

- Overseas Filipino Worker (OFW) remittance volumes

- Government infrastructure spending

- Foreign direct investment patterns

2. Sector-Specific Monitoring

Different sectors in the Philippine Stock Market react differently to economic changes. Investors should pay close attention to:

- Banking and financial services

- Telecommunications

- Real estate

- Infrastructure

- Technology and digital transformation sectors

3. Global Economic Interconnectedness

The Philippine Stock Market is not isolated. Investors must consider:

- United States Federal Reserve policy changes

- China’s economic performance

- ASEAN economic integration

- Global commodity price fluctuations

Risks and Limitations of Market Timing

Psychological Challenges

Market timing is as much a psychological challenge as a financial strategy. Common investor pitfalls include:

- Emotional decision-making

- Overconfidence in predictive abilities

- Panic selling during market downturns

- Missing out on significant recovery periods

Transaction Costs and Tax Implications

Frequent trading in the Philippine Stock Market involves:

- Higher brokerage fees

- Capital gains tax considerations

- Potential reduction in overall portfolio efficiency

Alternative Investment Approaches

1. Dollar-Cost Averaging (DCA)

A more conservative approach where investors:

- Invest fixed amounts regularly

- Reduce the impact of market volatility

- Minimize emotional decision-making

2. Long-Term Index Investing

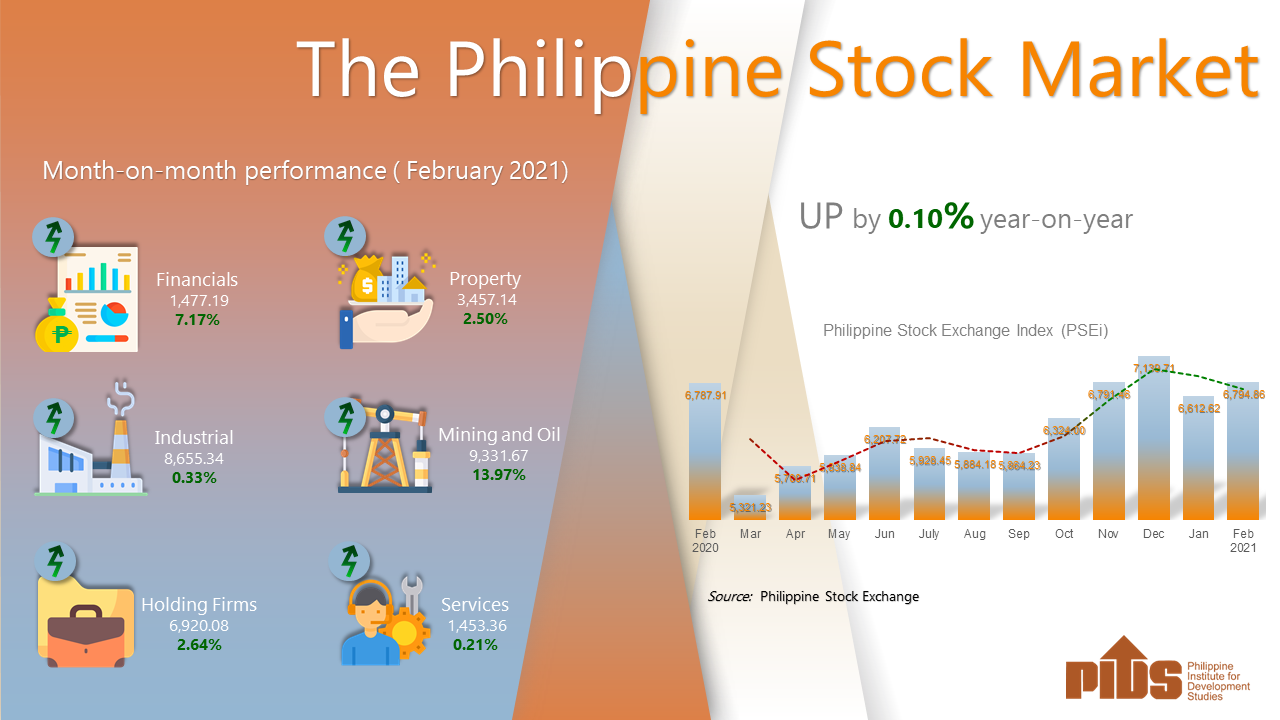

Tracking broad market indices like the PSEi (Philippine Stock Exchange Index) can provide:

- More stable returns

- Lower transaction costs

- Reduced complexity of investment strategy

Technological Innovations Impacting Market Timing

Digital Tools and Platforms

Modern Philippine investors now have access to:

- Real-time market data

- Advanced analytics platforms

- Algorithmic trading tools

- Mobile investment applications

These technologies have democratized market information and enhanced investors’ ability to make informed decisions.

Practical Recommendations for Philippine Investors

Strategic Market Timing Approach

- Develop a comprehensive understanding of market dynamics

- Continuously educate yourself about economic trends

- Maintain a diversified investment portfolio

- Use market timing as a complementary, not primary, strategy

- Leverage technology and data-driven insights

- Remain disciplined and avoid emotional trading

Conclusion: A Balanced Perspective

Market timing in the Philippine Stock Market is neither a guaranteed path to wealth nor a strategy to be entirely dismissed. Success requires a nuanced, informed, and disciplined approach.

By combining thorough research, technological tools, emotional intelligence, and a long-term perspective, investors can navigate the complexities of market timing more effectively.

Final Thoughts

Remember that no single strategy guarantees investment success. Continuous learning, adaptability, and a holistic view of your financial goals are paramount in the dynamic world of stock investing.

READ MORE RELATED BLOGS!

READ MORE AND SHARE!

TSOK Chronicles: Unleashing Passion, Dedication, and Excellence in 2024

2023 Your Practical Wedding Guide

Investments and Finance Ultimate Guide

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.