No products in the cart.

Investment, Stock Market

The Powerful Impact of Dividends in Stock Investing 2025

THE ROLE OF DIVIDENDS IN STOCK INVESTING

Understanding Dividends in Stock Investing

Dividends play an important role in stock investing by offering investors a steady income source and long-term financial growth. These payments reflect a company’s financial stability and commitment to rewarding shareholders. Understanding how they work can help investors optimize returns and build sustainable wealth over time.

What Are Dividends?

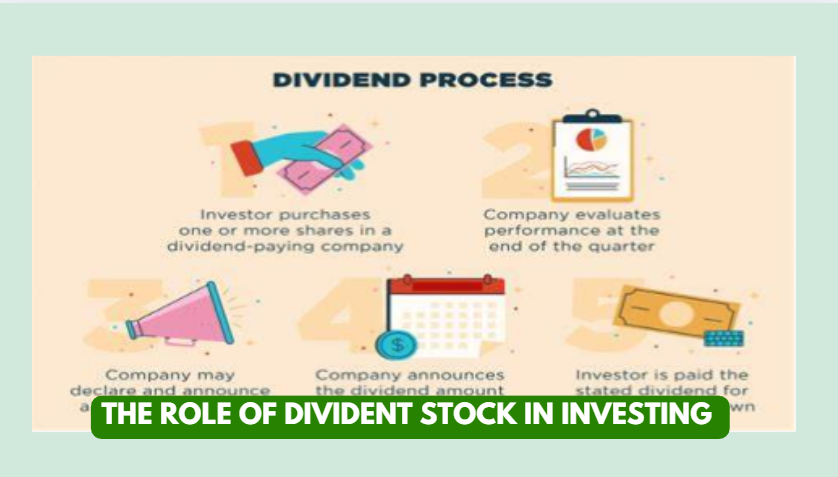

A dividend is a portion of a company’s earnings distributed to shareholders, typically in cash or additional shares. These payments are usually made on a quarterly basis, although some companies choose to distribute them annually, semi-annually, or even monthly. Dividend-paying companies are often well-established businesses with stable revenue streams, making them attractive to investors seeking passive income.

Dividends serve as a reward for investors who hold company shares. While not all companies pay them, those that do are often viewed as financially sound and shareholder-friendly. Dividend policies can vary from company to company, with some businesses prioritizing reinvestment in growth over distributing profits to shareholders.

Why Dividends Matter in Investing

Dividends provide investors with a passive income stream, which can be particularly beneficial for those focused on financial security and retirement planning. Companies that consistently pay dividends indicate strong financial health and profitability, making them appealing investment choices.

Additionally, dividend payments serve as a hedge against market volatility. While stock prices may fluctuate, receiving regular dividend payments can help investors generate steady returns, even during economic downturns. Many investors reinvest dividends to purchase additional shares, compounding their earnings over time.

Key Benefits of Dividend Investing:

- Steady Income: Regular payouts provide a predictable income stream for investors.

- Financial Stability: Companies that consistently pay dividends signal strong financial health.

- Compounded Growth: Reinvesting dividends can accelerate wealth accumulation.

- Inflation Protection: Dividend growth can outpace inflation, preserving purchasing power.

- Market Volatility Buffer: Dividend income provides stability during market downturns.

To learn more about why companies pay dividends, visit this comprehensive guide on Investopedia.

Types of Dividend Stocks

Dividend-paying stocks come in different categories, each with unique characteristics. Understanding these types can help investors choose the best fit for their financial goals.

1. Blue-Chip Stocks

These are issued by well-established companies with a long history of stable earnings and consistent dividend payments. Examples include companies like Johnson & Johnson, Coca-Cola, and Procter & Gamble. Blue-chip stocks are often considered low-risk investments due to their financial strength and reliability.

2. High-Yield Stocks

These stocks offer higher-than-average dividend yields, making them attractive to income-focused investors. However, high yields can sometimes indicate financial distress, so investors should carefully assess the company’s fundamentals before investing.

3. Dividend Growth Stocks

Companies that steadily increase their dividend payouts over time fall into this category. Dividend growth stocks, such as Microsoft and Visa, appeal to long-term investors seeking capital appreciation and growing income.

4. Real Estate Investment Trusts (REITs)

REITs are companies that own and manage income-generating real estate properties. They are required to distribute at least 90% of their taxable income as dividends, making them a popular choice for income-seeking investors.

5. Dividend Aristocrats

These are companies that have consistently increased their dividends for at least 25 consecutive years. They are considered some of the most reliable dividend stocks, offering investors stability and long-term income growth.

The Role of Dividends in Portfolio Diversification

Including dividend stocks in a portfolio helps balance growth, income, and risk management. Dividends not only provide steady earnings but also serve as a hedge against inflation and economic uncertainty.

For example, during bear markets, dividend payments can help offset capital losses from declining stock prices. Additionally, dividend stocks tend to be less volatile than non-dividend-paying stocks, making them a valuable component of a diversified portfolio.

Effective Strategies to Maximize Returns

Investors can apply the following strategies to get the most out of dividend stocks:

1. Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) allow investors to automatically reinvest their dividends to purchase additional shares. This approach harnesses the power of compounding, leading to exponential growth over time.

2. Dividend Capture Strategy

This involves buying stocks just before the ex-dividend date to collect the dividend payout and selling them soon after. While this can be profitable, it requires precise timing and may involve higher transaction costs.

3. Exchange-Traded Funds (ETFs) and Mutual Funds

Investing in diversified funds that focus on dividend-paying stocks can offer professional management and steady income. Dividend ETFs provide exposure to a broad range of dividend stocks, reducing the risk of individual stock selection.

4. Focus on Dividend Growth

Prioritizing stocks with a strong history of dividend growth can lead to higher income over time. Companies that increase their payouts consistently tend to be financially sound and resilient in various market conditions.

5. Tax-Efficient Investing

Understanding tax implications is crucial in dividend investing. Qualified dividends are often taxed at lower rates than ordinary income, while non-qualified dividends may be subject to higher taxes. Investing through tax-advantaged accounts like IRAs or 401(k)s can help maximize after-tax returns.

Risks and Considerations in Dividend Investing

While dividend investing offers many benefits, it also comes with potential risks. Investors should be aware of the following:

- Dividend Cuts: Companies may reduce or eliminate dividends during financial hardships.

- Interest Rate Sensitivity: Rising interest rates can negatively impact dividend stocks, particularly REITs and utilities.

- Sector Concentration: Over-reliance on specific sectors (e.g., utilities, consumer staples) may reduce portfolio diversification.

- Inflation Impact: While dividends can grow, inflation may erode purchasing power if payout increases do not keep pace.

Conducting thorough research and maintaining a diversified portfolio can help mitigate these risks.

Building Wealth Through Dividend Investing

A well-planned investment strategy can turn dividends into a powerful wealth-building tool. Whether an investor’s goal is passive income, portfolio diversification, or long-term financial stability, dividend-paying stocks offer reliable financial growth.

Long-Term Approach to Dividend Investing:

- Identify Strong Companies: Focus on financially healthy firms with a history of stable or growing dividends.

- Diversify Holdings: Spread investments across sectors to minimize risks.

- Reinvest Dividends: Utilize DRIPs to compound wealth over time.

- Monitor Performance: Regularly assess dividend sustainability and company fundamentals.

- Adjust Strategy as Needed: Stay adaptable to changing market conditions and investment goals.

By leveraging these investments wisely, investors can achieve financial security and maximize their returns. Dividend investing remains one of the most effective strategies for generating passive income and achieving long-term wealth creation.

Check out the Video for this Blog:

READ MORE RELATED BLOGS!

READ MORE AND SHARE!

TSOK Chronicles: Unleashing Passion, Dedication, and Excellence in 2024

2023 Your Practical Wedding Guide

Investments and Finance Ultimate Guide

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.