No products in the cart.

Investment, Stock Market

5 Steps to Convert Term Life Insurance to Whole Life Insurance in the Philippines

5 Steps to Convert Term Life Insurance to Whole Life Insurance in the Philippines

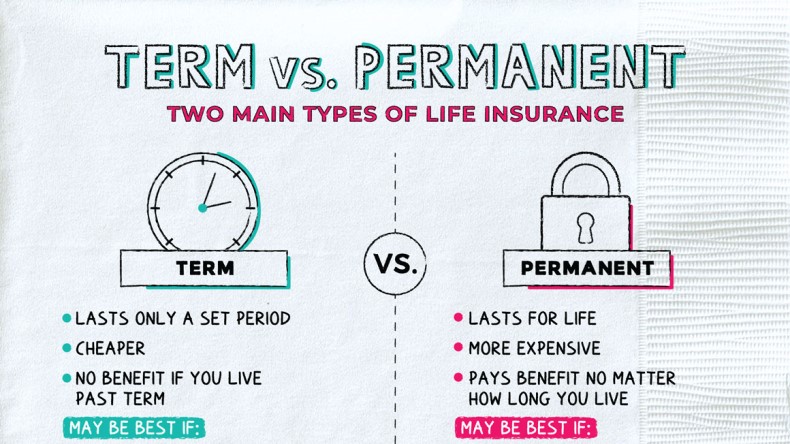

Term life insurance provides affordable and straightforward coverage for a fixed period, making it an excellent choice for individuals looking for temporary protection. However, as financial goals evolve, converting to whole life insurance may become a more appealing option. Whole life insurance offers lifetime coverage and a savings component that accumulates cash value over time.

If you’re considering converting your term life insurance to whole life insurance in the Philippines, here’s a comprehensive step-by-step guide based on insights from the Wealth Arki and Ready To Be Rich YouTube channels.

Step 1: Check Your Term Policy and Available Conversion Options

The first step in converting your term life insurance policy is to review the policy documents and understand what conversion options are available. Many term policies come with a conversion feature, allowing policyholders to switch to a whole life policy without undergoing a new medical exam. However, this option is usually time-limited, meaning you must convert before a specified deadline.

Key Actions:

- Review your policy terms to check for conversion eligibility.

- Determine the deadline for conversion to avoid missing the opportunity.

- Understand any restrictions that may apply to the conversion process.

Wealth Arki emphasizes the importance of knowing the specifics of your term policy to ensure a smooth and hassle-free transition to whole life insurance.

Step 2: Reassess Your Financial Goals and Current Needs

Your financial goals today may be different from when you first purchased your term life policy. Before converting, take time to evaluate your long-term financial objectives and how whole life insurance can support them.

Benefits of Whole Life Insurance:

- Lifetime Coverage: Unlike term policies that expire after a set period, whole life insurance lasts for life.

- Cash Value Accumulation: A portion of your premium contributes to a savings account that grows over timeand can be borrowed against if needed.

- Potential Dividends: Some whole life policies pay dividends, which can be reinvested, used to reduce premiums, or withdrawn.

Key Considerations:

- Do you need a policy that builds cash value for future needs?

- Are you planning for your family’s long-term security, including children’s education or retirement funds?

- Can you afford the higher premiums associated with whole life insurance?

Ready To Be Rich suggests consulting with a financial advisor to ensure that a whole life policy aligns with your overall financial strategy.

Step 3: Engage with Your Term Life Insurance Advisor

Once you’ve decided that conversion is the right move, schedule a meeting with your insurance agent or financial advisor. They can provide detailed information on available whole life policies and help you make an informed decision.

Questions to Ask Your Insurance Advisor:

- What types of whole life insurance are available (e.g., traditional, universal, variable)?

- How will the conversion affect my premiums?

- Are there any policy riders that could enhance my coverage (e.g., critical illness, disability waiver)?

- What are the cash value growth rates and dividend options?

Wealth Arki recommends comparing different whole life options and ensuring that the selected policy matches your financial capacity and long-term goals.

Step 4: Submit a Conversion Application

After reviewing your options, the next step is to officially apply for the conversion. Most insurance companies require a conversion request form, which must be completed and submitted along with any necessary documentation.

Important Notes:

- If you’re still within the conversion period, you usually won’t need a new medical exam.

- Ensure timely submission to avoid losing the conversion option.

- Clarify whether your new policy’s cash value starts accumulating immediately.

Ready To Be Rich stresses the importance of filing the application before the deadline to prevent missing out on the conversion opportunity.

Step 5: Review and Finalize Your New Whole Term Life Insurance Policy

Once your conversion application is approved, carefully review the new policy details before signing.

Key Aspects to Check:

- Coverage Amount: Ensure that the payout is sufficient for your financial needs.

- Premium Payment Schedule: Understand how often you need to pay and whether premiums are fixed or flexible.

- Policy Riders: Confirm that any additional benefits, such as critical illness riders or waiver of premium riders, are included as discussed.

- Cash Value and Dividend Options: If applicable, review how your policy will accumulate savings and whether you’ll receive dividends.

Final Steps:

- Ask your insurance agent to clarify any confusing terms.

- Make sure all necessary documents are signed and filed.

- Set up automated payments to ensure you never miss a premium.

Wealth Arki advises policyholders to read the fine print carefully and ensure that they fully understand the new policy before finalizing the conversion.

Additional Tips When Converting Term to Whole Term Life Insurance

1. Convert Early for Better Rates

The earlier you convert your policy, the lower your premiums will be. Insurance rates increase with age, so converting sooner can help you lock in lower rates.

2. Consider Partial Conversion

If you’re unsure about the cost of whole life insurance, some insurers allow partial conversions. This means you can convert only a portion of your term policy while keeping the rest as term insurance, reducing your financial burden.

3. Reassess Your Coverage Needs Over Time

Whole life insurance policies offer flexibility, so periodically review your policy to ensure that it still aligns with your financial situation and family needs.

Conclusion

Converting your term life insurance to whole life insurance is a strategic decision that provides lifetime protection and financial benefits. The process involves:

- Reviewing your term policy’s conversion options and checking eligibility.

- Reassessing your financial goals to determine whether whole life insurance aligns with your needs.

- Consulting with your insurance advisor to explore available options and costs.

- Submitting a conversion application within the allowed period to avoid medical re-evaluation.

- Finalizing your new whole life insurance policy, ensuring it includes all desired benefits and aligns with your financial goals.

By following these steps and leveraging insights from Wealth Arki and Ready To Be Rich, you can make an informed decision that secures both your financial future and the well-being of your loved ones.

READ MORE RELATED BLOGS!

READ MORE AND SHARE!

TSOK Chronicles: Unleashing Passion, Dedication, and Excellence in 2024

2023 Your Practical Wedding Guide

Investments and Finance Ultimate Guide

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia@gmail.com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.