No products in the cart.

Financial, Family And Children, Millennial, Working class

Pag-IBIG Housing Loan vs. Banking Loan: The Ultimate Guide to Smart Home Buying 2022

Tips to Consider on Where to Apply for your Housing Loan

Every Filipino family dreamt of buying their own house, making it their home. The reality is that buying any property here in the country is quite expensive. Saving up for one will take us a long time. Since assets are associated with inflation, the real estate cost heightens as the prices of goods rise. Making every Filipino family take away their dreams of buying their own home if it is impossible for them to afford it. This is where home loans enter the picture.

Mins to read: 9 minutes

Age Bracket: 26 – 40

Planning to purchase a house will be difficult if you do not have enough cash to pay for it. That is why housing loans will be our saving grace. Whenever housing loans are mentioned, we can’t deny that the Pag-Ibig fund will pop up in our heads. Of course, an amount is automatically deducted from our monthly salary as our contribution to the Pag-Ibig fund.

But, have you thought of applying for a loan from them to finance your house? Aside from this, banking loans are there as well to help you fund your dream home. You should consider them too since they offer better deals sometimes. Some prefer Pag-Ibig for their home loan, and some prefer banking loans. In this guide, we will help you decide which one suits you until you arrive at your final decision.

Pag-Ibig Housing Loan

Pag-IBIG is the country’s most profitable and best-performing financial institution. It is the biggest source of funds for home financing in the Philippines. Pag-IBIG fund housing loans allow you to borrow up to ₱6 million at a low-interest rate that comes with either Mortgage Redemption Insurance (MRI), Sales Redemption Insurance (SRI), or Fire and Applied Perils Insurance (FAPI), whichever is applicable.

They also offer Pag-IBIG Fund Affordable Housing Loan for Filipinos who earn minimum wage with an income of up to ₱15,000 a month within the National Capital Region (NCR) or earn up to ₱12,000 a month outside NCR. You can loan up to ₱580,000 in socialized division projects and ₱750,000 for socialized condominium projects with a subsidized rate of 3% per annum.

You can use your Pag-IBIG home loan to finance yourself if you’re planning to purchase a fully developed residential lot, a residential house and lot, a townhouse, or a condominium unit, construction or completion of your residential unit on your lot, your home improvement, or to refinance your existing loan.

Qualifications:

To qualify for a Pag-IBIG Housing loan, you must have:

- You should have at least twenty-four (24) monthly membership savings

- You should not be above 65 years old when you apply for the loan and not be more than 70 years old at the maturity of the loan

- Legal capacity to encumber real property

- Should have the ability to pass background checks/credit and employment/business checks of Pag-IBIG Fund.

- Has no outstanding Pag-IBIG Short Term Loan (STL) at the time of the application

- Has no foreclosed, canceled, bought back due to default, or subjected due to dacion en pago Pag-IBIG Housing Loan.

- You must update your account if you have an existing Pag-IBIG Housing Loan

Banking Loan

Bank available in the Philippines that offers housing loans for those in need. Some provide specific products for specific needs. Some give higher interest or loanable amounts than others. That is why you should be meticulous in choosing which bank you’ll apply for a loan. Deciding which is better between Pag-IBIG and Banking loans is also one thing to consider.

The Philippines’ banks offer housing loans with different rates, loanable amounts, and terms. We can compare their housing loan offers with the Pag-IBIG housing loan to see which has the most favorable terms when entering into significant debt.

Qualifications:

To qualify for banking home loans, you must be:

- A Filipino Citizen

- At least twenty-one (21) years old but not exceeding seventy (70) years old at the end of the loan term

- Have a gross monthly family income ranging from ₱30,000 – ₱50,000

- If employed, must be a regular employee for at least two (2) years

- If self-employed, the business should be operating for at least three (3) years

- Have a gross monthly family income ranging from ₱40,000 – ₱50,000

*qualifications vary from each bank

Pag-Ibig Housing Loan vs. Banking Loan

In terms of applying for a home loan, Filipinos usually opt for Pag-IBIG loans given that every employee in the country is required to contribute a percentage of their income to the Pag-IBIG fund. This is an advantage since applying in Pag-IBIG for home loans when you are an employee has benefits. However, applying for a home loan from a bank may come with perks and benefits as well.

Loanable Amount

| Pag-IBIG Housing Loan | Banking House Loan |

| a qualified Pag-IBIG member may apply for a housing loan of up to ₱6 million | Minimum of ₱400,000 |

| loanable amount is based on the capacity to pay, which will not exceed thirty to thirty-five percent (30% -35%) of the borrower’s income | Amount based on the proposed collateral House and Lot 80% Townhouse 80% Vacant Lot 60% Condominium 70% Personal Consumption 60% Renovation / Expansion 80% Refinancing 70% Reimbursement 80% *offers vary from each bank |

| Loanable amount is based on Loan-to-Appraised Value (LTV) Ratio | |

| Loanable amount up to ₱750,000 for Pag-IBIG Affordable Housing Loans |

For families that are eyeing on something pricey, bank loans are a more viable choice for property buyers since they offer loans that can cover as much as 80% of the property’s total price. However, if you are a low-income borrower, Pag-IBIG Home Loans is a more viable option for you since they offer loans up to ₱750,000.

If you need a high amount of money for your dream home, Pag-IBIG offers housing loans for up to ₱6 million. Being an employee in the country and an active member of Pag-IBIG gives you the advantage since borrowing such a huge amount in the bank requires strict requirements. There are also chances that you must be a depositor or have an account with the bank you want to apply to.

Interest Rate

| Pag-IBIG Housing Loan | Banking Housing Loan | |

| 1 year 5.750% 3 year 6.375% 5 year 6.625% 10 year 7.375% 15 year 8.000% 20 year 8.625% 25 year 9.375% 30 year 10.000% |

1 year 5.28% – 6.75%

2 year 5.28% – 7.00%

3 year 5.28% – 7.50%

4 year 6.28% – 7.88%

5 year 6.28% – 7.88%

*interest rates vary from each bank

| |

| For Pag-IBIG Affordable Housing Loan:

Borrowers with income up to ₱15,000 (NCR) and ₱12,000 (Regions) – 3% for first five (5) years

Borrowers with income up to ₱17,000 (NCR) and ₱14,000 (Regions) – 6.5% for the first ten (10) years |

In terms of interest rates, Bank Loans offer a higher interest compared to Pag-IBIG. Some banks offer a slightly lower interest rate, but most offer a high-interest rate, as per the table above.

Additionally, the fixed period of rates offered by Pag-IBIG is valid for up to 30 years, while the bank offers a fixed rate for only at least six years, or ten years at best.

Loan Term

| Pag-IBIG Home Loan | Banking Home Loan |

| The maximum payment period of the loan is thirty (30) years, but the borrower’s age should not exceed seventy (70) years old. | Loan terms range from 10 – 25 years depending on the property *loan terms vary from each bank |

Most of the time, loan interest and terms become the deciding factor whether you’ll apply to a certain bank or not. Pag-IBIG Home Loan term may be a significant factor to consider applying for them since it’s more favorable. However, bank loans may offer a shorter term; you can consider this a good option since borrowers may save up their money in the long run.

Other Comparison

| Pag-IBIG Home Loan | Banking Home Loan | |

| Miscellaneous fees | ₱3,000+ | Greater than or less than ₱15,000 |

| Loan Appraisal Value | 90% – 100% | 70% – 80% |

| Processing Period | Up to 15 business days | 5 – 7 business days |

In terms of additional fees such as the miscellaneous fees stated above, Pag-IBIG has the lower cost compared when you apply for a home loan in a bank. ₱15,000 is a massive amount for fees, and it is a pain in the pocket. However, the bank’s processing time is shorter than applying in Pag-IBIG. Still, it is better to ensure that all the documents needed are accurate and complete when submitting to avoid delays in the process.

Example computation

Seeing the differences in the value of the amount that they can loan based on the property’s value, how much income they need to lend their desired value, or how much they can loan based on their income would make a significant difference when deciding where they should apply for a loan.

Since many banks in the Philippines offer housing loans, we will use the BDO Home Loan Calculator since BDO is the top bank in the Philippines, according to Bangko Sentral ng Pilipinas.

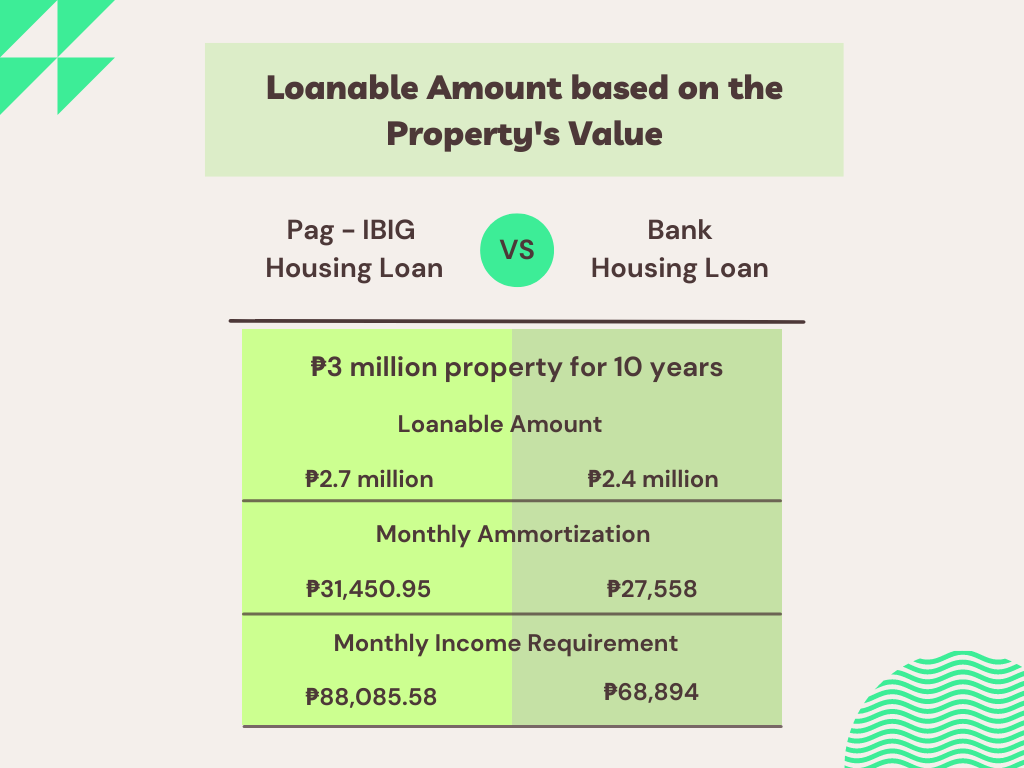

Loanable Amount based on the Property’s Value

Supposes you’re planning to purchase a 2-bedroom house with a lot worth ₱3 million, and you can’t decide where you will loan the amount you need that you want to repay ten (10) years. Let’s break it down for you.

Pag-IBIG Housing Loan

Using the Housing Loan Affordability Calculator by Pag-IBIG to calculate how much you can borrow based on the property’s value, we can input the necessary details needed, such as the estimated value of the property, preferred repayment period, and the preferred fixed pricing period.

With the example mentioned above, we can input ₱3 million as the estimated value of the property and ten (10) years as the preferred repayment period. As for the preferred fixed pricing period, we chose the five years fixed pricing period for 6.625%.

The approximate amount you can loan from Pag-IBIG is ₱2.7 million based on the appraised value of the property with monthly amortization of ₱31,450.95. The required gross monthly income is ₱88,085.58 for you to loan the amount.

Bank Housing Loan

With the help of the Home Loan Calculator from BDO, we can see the loanable amount based on the property’s value. We only have to input the property selling price and the fixed interest rate offered by the BDO.

In this case, we input ₱3 million as the property selling price and a 6.75% 1-year fixed interest rate. This resulted in a loanable amount of ₱2.4 million with a monthly amortization of ₱27,558 for ten years. The monthly income requirement for you to loan the amount is ₱68,894.

Observing the table above, you can lend a larger amount from Pag-IBIG than from Bausing Loans. However, the greater the loan amount, the higher the monthly amortization and the monthly income requirement. But if you have the budget to afford the monthly payments for your loan and you’re more focused on getting an amount to buy your dream property, I guess Pag-IBIG is the best choice. If you prefer something affordable and something you can reach the income requirement, the other one is for you.

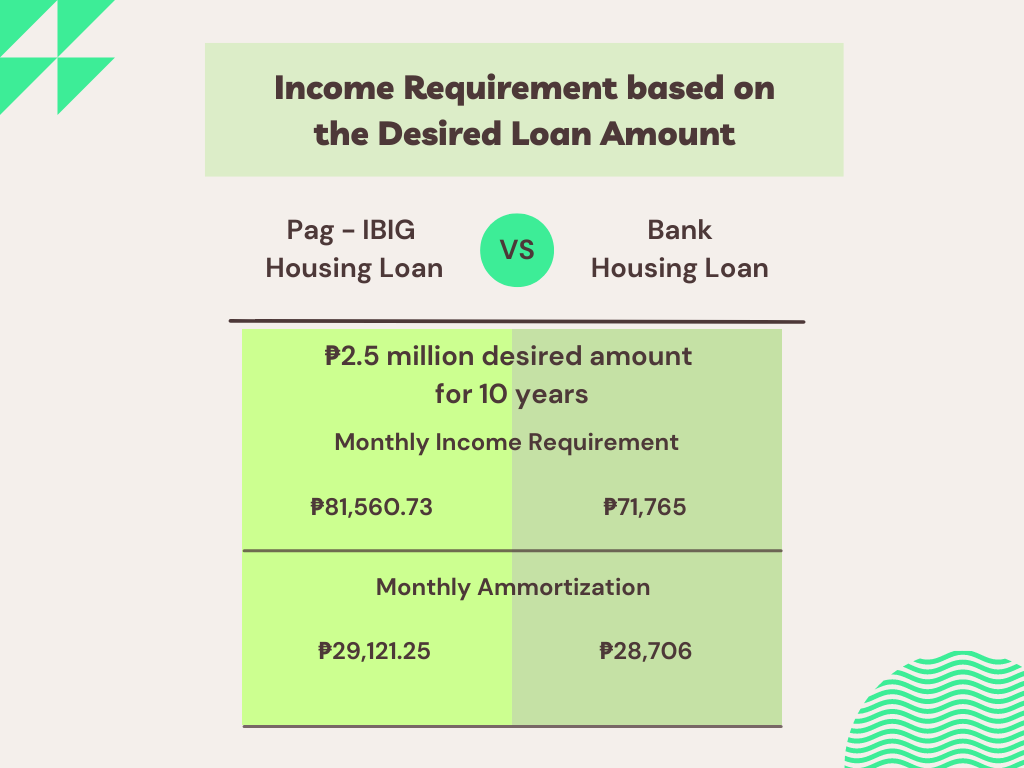

Monthly Income Requirement for Desired Loan Amount

Let’s say you want to buy a property or construct a home. However, you are short on cash for your dream home, and you need to loan an amount of ₱2.5 million that you want to repay for ten (10) years. Now, you’re worried if you can reach the monthly income requirement for your desired loan. Let’s see.

Pag-IBIG Housing Loan

In looking for the income requirement for your desired loan amount, the necessary details that we now need are your desired loan amount, preferred repayment period, and preferred fixed pricing rate.

Inputting all the details mentioned with the 5-year fixed pricing period of 6.625%, your estimated income requirement will be ₱81,560.73 with monthly amortization of ₱29,121.25.

Bank Housing Loan

Typing in your desired loan amount with a 1-year fixed interest rate of 6.75% on the BDO Home loan calculator, your monthly income requirement will be ₱71,765 with a monthly amortization of ₱28,706.

Seeing the differences between the two, Pag-IBIG is a thousand higher in terms of monthly income requirement and amortization. In this case, the bank home loan is much more affordable when it comes to loans for a house.

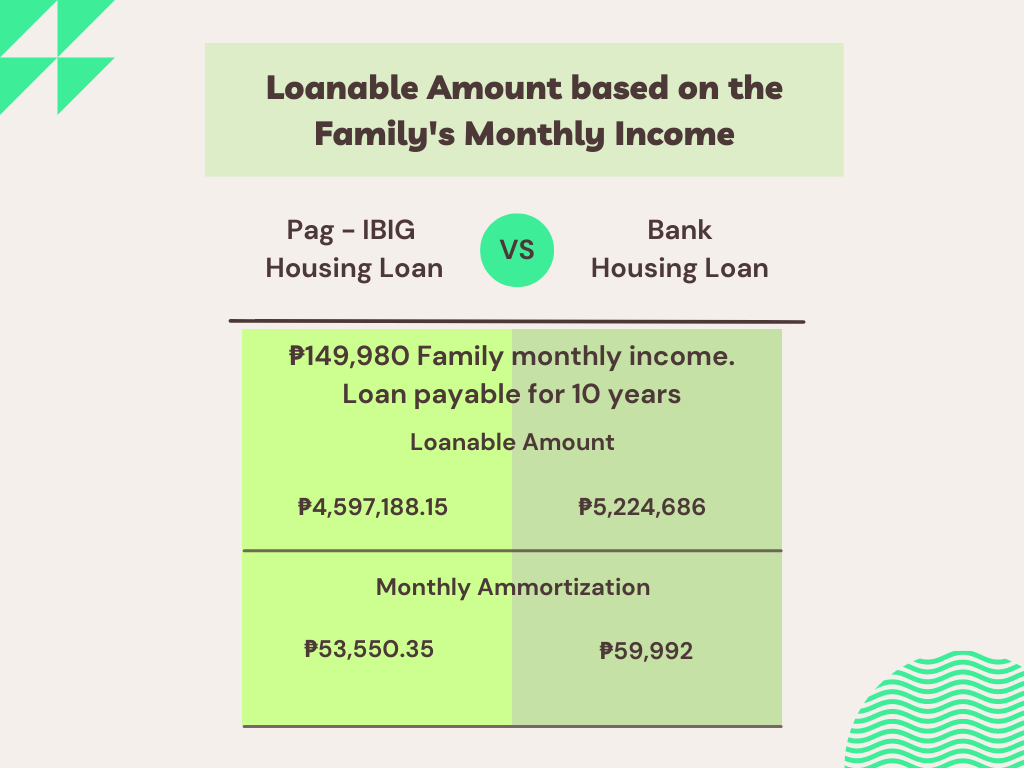

The Amount you can Borrow Based on your Income

According to Manila Times, the average Filipino Family’s Monthly income is around ₱149,980. We can use this as a value in the computation. How much can you borrow based on the average family income that you want to repay for ten (10) years?

Pag-IBIG Housing Loan

Inputting ₱149,980 in the Gross Monthly Income in the calculator with the preferred repayment period of ten (10) years and a 5-year fixed interest rate of 6.625%, the approximate amount you can loan is ₱4,597,188.15 with a monthly amortization of ₱53,550.35

Bank Housing Loan

To find the estimated amount you can borrow based on your monthly income, we all have to do is to type the monthly income in the calculator and your preferred fixed interest rate. I have typed ₱149,980 as the monthly income and a 6.75% 1-year fixed interest rate to see the estimated amount you can loan. This resulted in an amount of ₱5,224,686 estimated loanable amount with a monthly amortization of ₱59,992. You can purchase a property with an estimated amount of ₱6.5 million using the amount you borrowed.

After doing the computations showed that you can loan a higher amount to the bank compared to Pag-IBIG. However, the higher the loan amount, the higher the monthly amortization you have to pay. Also, take note that the advantage of being a member of Pag-IBIG gives you the benefit of applying and approving your loan without much of a hassle compared to applying for a massive amount of loan from the bank since banks can be strict in terms of requirements and qualification before approving a loan.

Take note that the computations and examples given and done above are just approximations of the amount shown in a particular situation and for illustration purposes only. The prevailing rates and amounts are subject to the bank where you plan to apply. The Bank Housing Loan’s example is based only on the BDO’s computation. Rates and calculations may change depending on the bank since offers vary from each bank.

Final Thoughts

In conclusion, Pag-IBIG Home Loans and Banks’ Home loans have perks. Given the commitment you will give in applying for a loan, it is best to consider all the pros and cons of the offer. The final decision will always be based on the borrower’s financial capability, eligibility, and lifestyle.

Doing your research is a good idea. However, consider talking to or consulting real estate professionals and trusted finance for you to be more knowledgeable about the loan you’re planning for and make the most informed decision possible. Understanding the fixing period rates, repayments, terms, and conditions of your loan is a must to avoid conflict in your payments. After all, we do not want a bad credit history.

MUST-READ AND SHARE!

2023 Your Practical Wedding Guide

Your Ultimate Access to Kuwait Directories in this COVID-19 Crisis

Investments and Finance Ultimate Guide

OFW FINANCE – Money News Update that you need to read (Table of Contents)

A Devotional for having a Grateful Heart

Stock Investment A Beginner’s Guide

How To Save Money Amidst Inflation

Philippines Best Banks with High-Yield Savings Return

Essentials Before Applying For a Credit Card

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.