No products in the cart.

Financial

Ways and Requirements to Get your First Credit Card in the Philippines

According to the Global Economy, 19.28% of people aged 15 yrs old and above had a credit card in the Philippines from 2011 – 2017, ranked 29 in Asia. Meanwhile, imagine how the numbers went up from 2017 up until now. Given the access to the internet that the Philippines has today and the number of e-commerce trends right now. Everyone is fascinated to have that small plastic card that they can use to purchase anything they see online.

Aside from this, the types of credit cards and the bank’s perks may have increased people’s fascination with wanting to have them. Think about all the rewards and mile points you can get on your every purchase. Who won’t be drawn to that?

MINS TO READ: 8 minutes

Being part of that number requires a lot of preparation and requirements before having that card in your hand. Preparing for the application is vital to ensure your chances of getting approved. Applying may be the part where you get nervous, but don’t fret. There are two options now in applying for a credit card. Requirements might be tricky, but I have listed down the banks that offer credit card services you can consider and their requirements and qualifications when you decide to apply.

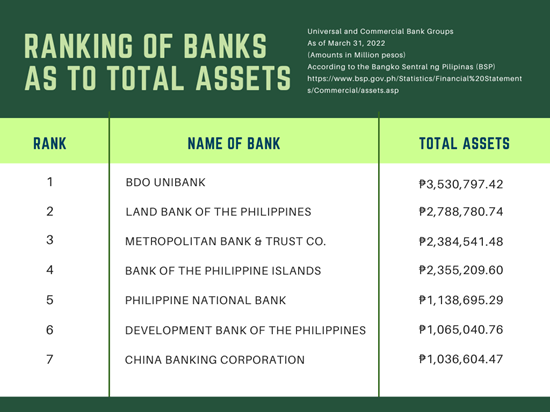

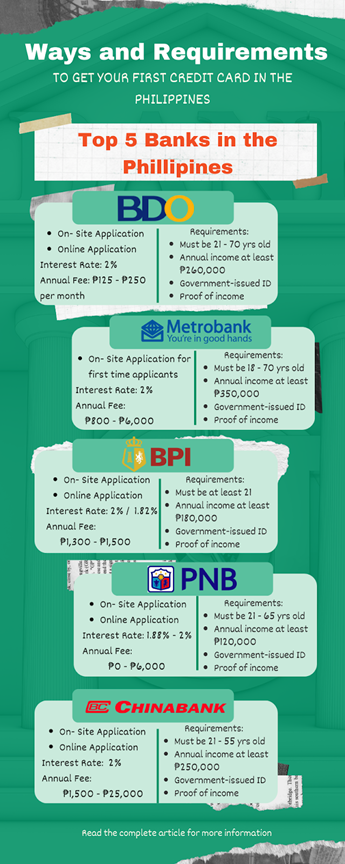

Top 5 Banks in the Philippines

BDO UNIBANK INC

BDO is a full-service universal bank that offers an array of services, including retail banking, lending, credit cards, corporate cash management, etc., with 1,472 branches and 4,439 ATMs all over the country. It was initially known as Acme Savings Bank when it was founded in 1967 as a thrift bank. It was acquired by the SM Group in 1976 and renamed Banco de Oro Savings and Mortgage Bank. BDO listed its shares on the Philippine Stock Exchange on May 21, 2002.

Through continuous growth and selective acquisitions that resulted in the continued expansion and maximized its financial performance, BDO became the largest bank in the Philippines as of March 31, 2022, in terms of assets amounting to ₱3.53 trillion according to the Bangko Sentral ng Pilipinas.

BANK OF THE PHILIPPINE ISLANDS

BPI was the first bank established in Southeast Asia in 1851, originally known as El Banco Español Filipino de Isabel II. It is a universal bank that offers a wide range of services, such as consumer banking and lending, asset management, payments, and so much more. Its shares are listed on the Philippines Stock Exchange, and BPI is a Philippine Stock Exchange Index (PSEi) member. Its primary shareholders were the Roman Catholic Church’s endowments and charities, and its director includes Antonio de Ayala; until now, the Ayala Corporation now owns the 48.5 percent effective interest in BPI, while the Roman Catholic Archbishop of Manila owns 7.3 percent.

BPI is now the leading provider of financial services in the Philippines and is considered one of the top banks in the country in terms of assets amounting to ₱2.35 trillion, according to the Bangko Sentral ng Pilipinas. They now offer 1,173 branches (locally and in Hong Kong and Europe) and 2,707 ATMs and cash deposit machines.

CHINA BANKING CORPORATION

Chinabank is the first privately owned commercial bank established by Dee C. Chuan on August 16, 1920, at No. 90 Rosario St., Binondo, Manila. Chuan’s goal was to enable Chinese merchants to participate in the growing economy, which is why its initial clients were Filipino-Chinese Businessmen. Chinabank was one of the first companies listed on the Philippine Stock Exchange in 1927 and is now a part of the SM Group. It offers a variety of services that cater to institutional and individual customers.

Combining eastern values became the bank’s principle as it maintained the multi-generational relationships within the Chinese-Filipino community; Chinabank flew its way to the top as it is considered one of the top banks in the Philippines regarding assets amounting to ₱1.03 trillion.

METROPOLITAN BANK & TCO

Metropolitan Bank & Trust Co. is one of the premier universal banks founded on September 5, 1962. It was established in Binondo, Manila, by a group of Filipino businessmen led by Dr. George S.K. Ty to cater to the Filipino-Chinese community residing in the area and offer bank and financial services. In 1963, Metrobank opened its first local bank and expanded beyond the country. It was listed on the Philippine Stock Exchange in 1981 and acquired its universal banking license in the same year.

Metrobank is the first private bank in the Philippines that opened in the US with its office in Guam in 1975. Currently, it offers a wide range of banking products and services worldwide, with 706 branches in the country, 1,774 ATMs, and 32 foreign branches.

PHILIPPINE NATIONAL BANK

Philippine National Bank is the First Universal Bank in the Philippines. It was initially established as a government-owned bank on July 22, 1916, in Escolta, Manila. Its primary goal was to provide financial aid to the industry and agriculture of the country as well as to support the country’s economic development. PNB established its first branch in New York City, where it entered the field of international banking. PNB paid its ₱6.1 billion loans from the Philippine Deposit Insurance Corporation (PDIC), making it fully privatized in 2007.

With the bank’s consistent and reliable service to Filipinos and OFWs, providing bank services even overseas, PNB continues to extend its hand to every Filipino worldwide. That said, the company has 716 branches and 1,710 ATMs; for Filipinos that need a hand in banking services in foreign countries, PNB has around 70 branches internationally.

*Land Bank and DBP are not included in the article since they are a government-owned bank that does not offer credit cards

Credit Card Requirements in the Philippines

BDO (Banco de Oro)

Application

- On-site Application – Visit any BDO branch near you, fill out their credit card application form, and submit the required documents.

- Online Application – Visit https://www.bdo.com.ph/click-your-way-your-first-credit-card. Complete the application form and submit the necessary documents. Wait for a call from BDO within three (3) banking days to confirm your application.

The standard time for application is around seven (7) working days from the date the application is confirmed, and all the required documentation is submitted.

Qualifications

- You must be 21 – 70 years old.

- Filipino citizen or a foreigner with a permanent residence in the Philippines for at least two (2) years

- A gross annual income ranging from ₱260,000 to ₱1.2 million (varies from the card)

- If employed, must be a regular employee.

- If self-employed, the business must be registered and operating for at least two (2) years.

- Must have at least one (1) landline phone

- The residence or Office Address must be within any area with a BDO Branch.

Requirements

- Any valid photo-bearing ID with a signature issued by an official authority or by the Philippine Government

- Proof of income documents:

For Employed applicants:

- Latest BIR Form 2316 signed by employer’s representative (Photocopy)

One of the following

- Certificate of Employment and Income (COEI) (Original Copy)

- Latest full-month payslip (Photocopy)

For Self-Employed Applicants:

- Registration of Business Name (Photocopy)

- For Single Proprietorship issued by DTI

- For Partnership / Corporation issued by SEC

- Latest ITR and W4 with BIT / Bank Stamp

- Audited Financial Statements for the last two (2) years; OR

- Bank Statements for the previous three (3) months

For foreigner applicants

- Copy of Employment Contract or Certificate of Employment

- Letter from Embassy

- A photocopy of ANY ONE of the following:

- Valid Passport with Resident Visa

- Work Permit and Valid Visa

- Special Investor’s Resident Visa and Visa’s Philippine Economic Zone Authority or Visa with EO226

- ACR or ICR or ACR – 1

Application Status

To know the status of your credit card application, you can contact them through these steps below.

- BDO Official Website

- Visit https://www.clg.bdo.com.ph/web/clg/customer-service/inquiry-app-status

- Input the necessary information needed. You can choose either of the options given;

- TIN Number

- SSS Number

- Click “Submit.”

- BDO Branch

You can call the BDO Branch, where you filed your credit card application, to find out the status of your application.

BPI (Bank of the Philippine Islands)

Application

- On-site Application – Visit any BPI branch near you, fill out their credit card application form, and submit the required documents.

- Online Application – Visit https://www.bpi.com.ph/cards/pq/landing and fill out their online application form with information about yourself, your finances, employment, and personal references.

The Credit Card application usually takes one to two weeks. It is suggested not to apply for another BPI Credit Card as this may affect your pending application.

Qualifications

- You must be at least 21 years old

- Filipino Citizen or a Philippine resident

- A gross annual income of at least ₱180,000

- Must have an active business or residence contact number

- Residence or office address must be within a 30km radius of a BPI Branch or Provincial Business Center

Requirements

- Any valid government-issued ID

For:

- Employed Applicants:

- Latest BIR Form 2316 (Photocopy)

- Certificate of Employment (COE)

- Latest Pay Slips

- Self-Employed Applicants:

- Latest Audited Financial Statements with BIR or Bank Stamps

- Latest Income Tax Return with BIR or Bank Stamps

- Foreign Applicants

- Passport

- Alien Certificate of Registration

- Work Permit or Embassy Accreditation Papers

Application Status

BPI will contact you regarding your credit card application status. If you haven’t heard from them after two (2), it’s most likely that your application will be declined. However, there are ways to check your credit card application status.

BPI Online Banking Facility

- If registered with their online banking facility, visit their website at www.bpi.com.ph and log in to your account.

- Click Other Services > Application Status Inquiry > Credit Card

- Enter the date of your application

BPI Credit Card Hotline

- Metro Manila : (+632) 889-10000

- Domestic toll-free: (+632) 1-800-188-89-100

- Mobile phone: (+632) 889-10000

- Call the BPI Credit Card Hotline

- Dial 2 for credit cards and 2 for Credit Card Application Status Inquiry

- Enter your 10-digit application ID number

Chinabank

Application

- On-site Application – Visit any Chinabank branch near you, fill out their credit card application form, and submit the required documents.

- Online Application – download the China Bank Credit Card Application Form at https://www.chinabank.ph/pdf/Credit-Card-Application-For-Principal-Cardholder.pdf. Fill out all the fields needed in the application form and send a scanned copy of the form together with all the necessary documents required to cardsales@chinabank.ph.

When the form is filled out and submitted with complete documents, the application process will take around 10 – 15 banking days.

Qualifications

- You must be 21 – 55 years old.

- A Filipino citizen or a foreigner working and residing permanently in the Philippines.

- A gross annual income of at least ₱250,000

- If Employed, must be a regular employee

- If Self-Employed, the business should be operating legally for at least two (2) years.

- Must have an active and valid e-mail address, mobile, and landline number.

- Must have an SSS / GSIS &/or TIN

Requirements

- Valid Government-issued ID with photo and signature

- Proof of Income

For Employed Applicants (at least one of):

- Latest BIR Form 2316

- The latest three (3) month pay-slips

- Original Certificate of Employment

For Self-Employed Applicants:

- Latest BIR Form 1701

- Audited Financial Statements as received by the BIR

- For Non-Immigrants and Embassy employees

- Photocopy of passport or visa

- Alien Certificate of Registration / I-Card (ACR/ICR)

Application Status

China Bank Hotline

- China Bank Hotline +632 888-55-888

- Domestic Toll-Free Number 1-800-1888-5888

- Call China Bank Hotline on the given contact information above.

- Press option 2 for Credit Card Services, then press 4 for Credit Card Application Status.

- Have your SSS / GSIS / TIN ready for identification purposes.

Metrobank

Application

- On-site Application – On-site application is the only option if it is your first time applying for a credit card. Visit any Metrobank branch near you, fill out their credit card application form, and submit the required documents.

Upon submission of your application, it will be evaluated and processed within 2 – 3 weeks.

Qualifications

- You must be 18 to 70 years old

- Have a valid landline number

- Valid TIN, SSS, or GSIS

- A minimum gross annual income of ₱350,000

Requirements

- A government-issued photo-bearing ID with date of birth and signature

- Proof of income:

If Employed:

- Copy of the latest Income Tax Return (ITR) stamped as received by the BIR or its authorized agent bank

- Employee’s copy of BIR Form 2316 signed by the employer

- Copy of last three months’ payslip

- Original copy of Certificate of Employment (COE)

If Self-Employed:

- Copy of the latest Audited Financial Statements (AFS) with the bank or BIR Stamp

- Copy of the Income Tax Return (ITR) stamped as received by the BIR or its authorized agent.

Application Status

- Customer Service Hotline

24-Hour Customer Service Hotline at 88-700-700

Domestic Toll-free number at 1-800-1-888-5775

- Call the 24-hour Customer Service Hotline on the contact numbers given above.

- Message via email

- Send a message via email to customerservice@metrobankcard.com to know your credit card application.

PNB (Philippine National Bank)

Application

- On-site Application – Visit the nearest PNB Branch near you with a copy of your requirements and its original copy. Fill out their application form and submit all your documents.

- Online Application – Visit https://portal.pnb.com.ph/mib/login.do?app=PN&page=ccapplication, click the “New Credit Card Application,” choose your preferred Credit card and fill out their online application form with information about yourself, your finances, employment, and personal references.

The processing time of the application is around four to six weeks upon submission of your requirements.

Qualifications

- You must be 21 – 65 years old

- Filipino citizen and Philippine resident

- A gross annual income of at least ₱120,000

- Employed as a regular employee for at least one (1) year

- Self-employed profitably for at least two (2) years

Requirements

- Photo-bearing Government-issued ID with signature

- Proof of billing (Utility Bills such as electricity, telephone, etc.)

For employed applicants (any of the following):

- A recent one (1) month’s payslip

- Certificate of employment

- ITR

- For Self-employed Applicants:

- Latest Income Tax Return with BIR Stamp

- Latest Audited Financial Statements

For Foreign National Applicants:

- Passport

- Alien Certificate of Residence OR Unexpired Philippine Retirement Authority OR Special Resident Retiree’s Visa

Any of the following:

- National ID

- Internal Revenue Services ID

- Social Security Number ID

- Driver’s License

- Work Permit issued by DOLE if employed in the Philippines

- Company ID issued by private entities

- Bureau of Immigration Approved Order

Application Status

- PNB Credit Card Hotline (24/7 Service)

You can call their credit card hotline at (+632) 8818-9818 if you wish to know your credit card application status.

- PNB Email Address

You can also email them your credit card application status inquiry at pnbcreditcards@pnb.com.ph.

- PNB Account Access Portal

Visit https://portal.pnb.com.ph/mib/login.do?app=PN&page=ccapplication and click “Credit Card Application Status Inquiry,” and provide your reference number, date of birth, and ID Number.

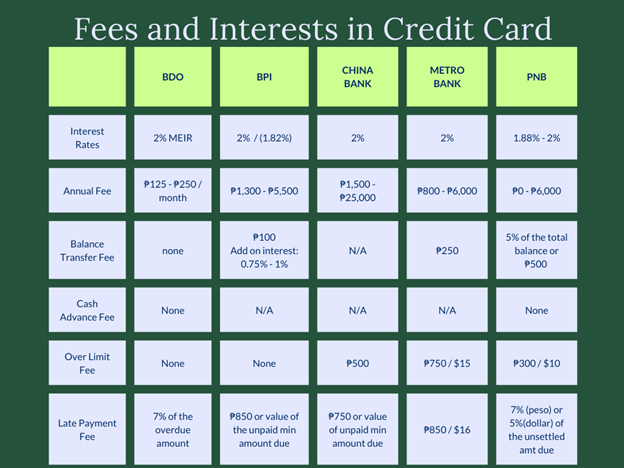

Fees and Interest Rates Offered by the Bank

A credit card may be a good thing to purchase anything you want, but the “pay later” part of the credit card has a catch. Every credit card charges you an interest rate for the privilege of allowing you to borrow money. This interest rate is applied to your balance or the amount you spent for the month.

The bank will charge interest on your outstanding balance if you do not pay your monthly due in full. Interest will be charged to you continuously until you fully pay off your credit card’s outstanding balance.

In addition to that, note that fees are also charged to you. That is why knowing how these credit card fees work will help you use your credit card responsibly to minimize the costs you can charge. First, take note of these credit card terms to know why these fees are charged to you.

- Annual Fee – a fee you pay annually for using your card. This fee will still be paid even if you don’t use your card often. Some credit card offers no annual fee or even waive it for the first year.

- Balance Transfer Fee – balance transfer means transferring your credit card balance to your other credit card that may offer a lower interest rate so you can pay it off quickly. However, moving your balance from one card to another costs a fee.

- Cash Advance Fee – Other than using your credit card for in-store and online purchases, you can also withdraw money from your credit card through ATM, which costs a fee. It is suggested to avoid withdrawing cash from your credit card.

- Over Limit Fee – your credit card comes with a credit limit. Once you’ve attained your limit but still have to purchase something using your credit card, you can be charged for exceeding your limit. Some banks may automatically decline your purchase in this case, but most banks usually just charge you for exceeding your limit. Still, beware, as this still can inflate your bill.

- Late Payment Fee – time flies so fast, and you may forget to pay your credit card due on time. Paying late also requires you to pay a fee. To avoid this situation, always schedule your payments so you won’t miss them.

Source: https://www.bsp.gov.ph/Pages/InclusiveFinance/CreditCardInterestRates.aspx

Computing your monthly payment

Knowing how much you need to pay in a month will be convenient. Planning ahead and seeing if you can afford to pay an amount in a month is a jumpstart on managing your finances. Here are some terms that you should know in computing your monthly payment.

- Annual Percentage Rate (APR) – the annual interest charged on your credit card

- Balance – the amount you owe the bank or the amount you spent

- Outstanding Balance – the unpaid balance on your credit card

- Statement – a copy of all of your credit card activities given to you monthly that includes your payments, transactions, fees, etc.

To compute your monthly payment, here’s what you have to do;

Credit Card Interest Computation

Suppose you know your APR and Balance for this month. To know your monthly interest rate, divide your APR by 12 (given that there are 12 months in a year).

monthly interest rate =(APR12)

Now, divide your monthly interest rate by 100 then, multiply it by your account balance to have your balance’s interest charged on your balance. The interest charged will add to your balance to have your total amount of payment that you need to pay.

balance’s interest :monthly interest rate100 balance

Total amount : balance’s interest + balance

To show you how this is computed, here’s an example:

APR : 24% Balance: ₱8,000

monthly interest rate% =(2412) =2%

balance’s interest =2100 8,000 = 0.02 8,000 = 160

Total monthly payment : 160 + 8,000 = ₱8,160

Credit Card Interest Computation with an Outstanding Balance

In a case where you have an unpaid balance on your previous monthly payment, this is how you can compute it

Count the number of days after your current statement up to the day before your payment due date. After that, e will multiply the number of days to your previous balance

(number of days between your current statement and payment due date) previous balance = X

Next is to count the number of days from your payment due date up to your next statement date. Deduct your current payment balance to your previous balance and multiply the answer by the number of days you counted.

(previous balance – current payment balance) (number of days) = Y

We now have to add up all the balances that we have computed ( X and Y ) and divide them by the number of days between the previous statement up to the current statement to have the amount of your total balance.

( X + Y) / (number of days ) = total balance

Now that you have your total balance, you can use the computation in the first part to have your total amount to be paid. A sample to show how to compute:

Current Statement Date: August 1, 2022

Next Statement Date: September 1, 2022

Previous Balance: ₱8,000

Payment Due Date: August 20, 2022

Payment Date: August 20, 2022

Current Payment amount: ₱7,000

APR : 24% ( 2% monthly interest)

19 8,000 = 152,000

(8,000 – 7,000) x 13 = 13,000

(152,000 + 13,000) / 31 = 5,322.58 (total balance)

5,322.58 X 0.02 = 106.45 (interest charged)

5,322.58 + 106.45 = 5,429.03 (total amount balance to be paid)

To Calculate your total amount to pay might be hard at first. It’ll be easy as you get the hang of it.

Calculating your Late Payment Fee

Paying your monthly payments late comes with a cost. Some banks offer a constant amount of fees when you pay late, but some offer only a percentage of your balance. Additionally listed on the table above are some examples of late payment fees, and now, we will be using BDO as an illustration in the part.

BDO offers 7% of your overdue amount as your late payment fee. To compute this, you have to multiply your overdue balance to the percentage rate divided by 100.

Late Payment Fee : balance percentage rate100

For instance, this on how it is computed. Suppose that you have an ₱10,000 overdue balance on your BDO Credit Card that offers 7% on your overdue amount as a late payment fee. Thus,

Overdue Amount: ₱10,000 Late payment rate: 7%

Late Payment Fee = balance percentage rate100

Late Payment Fee = ₱10,000 7100

= 700

Therefore, you will be paying an amount of ₱700 as your late payment fee.

READ MORE RELATED BLOGS!

READ MORE AND SHARE!

TSOK Chronicles: Unleashing Passion, Dedication, and Excellence in 2024

2023 Your Practical Wedding Guide

Investments and Finance Ultimate Guide

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.