Financial, Fresh graduate, Young Adult

Introduction to Cryptocurrency: A Beginner’s Guide

In a short amount of time, cryptocurrencies have gone from being technological novelties to becoming trillion-dollar innovations that could completely alter the global financial system. A growing number of people hold Bitcoin and hundreds of other cryptocurrencies as investments in addition to using them to buy everything from software to real estate.

Any form of money that exists digitally or virtually and uses cryptography to secure transactions is known as cryptocurrency, also called crypto-currency or crypto. Cryptocurrencies use a decentralized system to track transactions and create new units rather than a central body to issue or regulate them.

Cryptocurrencies have gained popularity over the past several years; as of 2018, there were more than 1,600 cryptocurrencies. Furthermore, the number keeps increasing. As a result, there is a rise in demand for blockchain developers (the underlying technology of cryptocurrencies such as bitcoin). Blockchain developers are highly valued, as evidenced by their salaries: the average annual Cryptography salary as of September 2022 is $150,009 or Php 8,603,841.20. Even a specific website for cryptocurrency jobs exists.

Category: Young Adult, Fresh Graduate

Age: 18-21 years old

“Investing in Crypto is like being married, you have to keep going through the good and the bad, for better or for worse, for richer or for poorer TIL death do us part. HODL” – Najah Roberts

Here’s what investors should know about cryptocurrency and how to start with your crypto investments:

What is Cryptocurrency?

What is cryptocurrency? A cryptocurrency is an alternative payment method developed using encryption algorithms, it is also known as a digital currency. By utilizing encryption technology, cryptocurrencies can serve as a virtual accounting system and a medium of exchange. You need a crypto wallet in order to use cryptocurrencies. These wallets are available for download as software for use on computers, mobile devices, and cloud storage. The wallets keep your encryption keys, which are used to connect to your cryptocurrency and verify your identity.

The fact that cryptocurrencies are typically not issued by any central authority makes them theoretically immune to government interference or manipulation.

Without outside intermediaries, cryptocurrencies make it possible to make secure online payments. The term “crypto” refers to the various cryptographic methods that protect these entries, such as hashing, public-private key pairs, and elliptical curve encryption.

It is possible to mine cryptocurrencies or buy them from exchanges. Not all online stores let customers use cryptocurrencies to make purchases. In reality, hardly any retail transactions are conducted using cryptocurrencies, even well-known ones like Bitcoin. However, the exponential growth in the value of cryptocurrencies has increased their acceptance as trading commodities. They are used for cross-border transfers to a limited extent.

How Does Cryptocurrency Work?

Blockchain technology is the one that supports Bitcoin, and the majority of other cryptocurrencies keep a tamper-resistant record of transactions and keeps track of who owns what. The development of blockchains solved the issue of preventing people from duplicating their holdings and trying to spend it twice that plagued earlier attempts to create purely digital currencies.

Value of Cryptocurrency

A variety of factors influences a cryptocurrency’s value. Finding the most valuable cryptocurrencies can be challenging, given the abundance of cryptocurrencies.

Demand is one of the primary factors influencing a cryptocurrency’s value like it is for many other assets. A coin’s price is more likely to rise if more people use it or the blockchain connected to it.

Since more people use well-known cryptocurrencies like bitcoin and Ethereum, their perceived value is higher. The prices of bitcoin and Ethereum are higher than those of other cryptocurrencies because more people use those networks. Some experts also mention the first-mover advantage that bitcoin and Ethereum possessed in creating the market.

Supply and demand may also affect a cryptocurrency’s price or, at the very least, how investors view its worth. Since there is a limit on the number of bitcoins that can exist, many experts believe that bitcoin is more likely to maintain its value. It’s wise to consider coins with a compelling use case and a higher likelihood of becoming more widely adopted when deciding which cryptocurrencies to invest in. Due to its ability to support smart contracts, Ethereum can create various applications, including those in the financial and gaming industries, which is one of the reasons it is valued highly (second only to bitcoin).

According to Bankrate, as of September 16, 2022, the value of the top cryptocurrencies are as follows:

1. Bitcoin (BTC)

Price: $19,724 (Php 1,132,033.41)

Market cap: $377 billion (Php 21.6 trillion)

2. Ethereum (ETH)

Price: $1,453 (Php 83,392.55)

Market cap: $178 billion (Php 10.2 trillion)

3. Tether (USDT)

Price: $1.00 (Php 57.39)

Market cap: $68 billion (Php 3.9 trillion)

4. USD Coin (USDC)

Price: $1.00 (Php 57.39)

Market cap: $50 billion (Php )

5. BNB (BNB)

Price: $275.27 (Php 15,799.18)

Market cap: $44 billion (Php 2.5 trillion)

6. Binance USD (BUSD)

Price: $1.00 (Php 57.39)

Market cap: $21 billion (Php 1.2 trillion)

Storing Cryptocurrency

There are many ways to store Cryptocurrency. You can keep your coins on a lot of cryptocurrency exchanges. Your coins could, however, be subject to a hack if they are stored on an exchange. It’s important to note that crypto investments do not have the same federal protections and guarantees as your traditional stock portfolio, even though some deals maintain insurance to help reduce losses.

Using a crypto wallet is the safest way to store cryptocurrency. Wallets come in two main categories:

Hot Wallets: Hot wallets are online wallets that you can use your phone or a browser to access. You can connect them to various online marketplaces, which are easy to access. From an exchange, you can quickly send your cryptocurrency to a hot wallet to store them separately. Software wallets are another name for hot wallets.

Many hot wallets are available, and while they all perform the same fundamental operations, they are not all equal. Here are the best crypto wallets in the Philippines:

Crypto.com – Overall Best Crypto Wallets in the Philippines

Capital.com – Best Bitcoin Wallet in the Philippines for CFD Traders

Binance – Best Bitcoin Wallet in the Philippines for Low Fee Trading

Coinbase – Crypto Wallet in the Philippines with User-Friendly Interface

Cold Wallets: The cold wallets don’t have an internet connection. Hardware wallets that resemble USB drives are these. Although they are frequently more expensive than hot wallets, cold wallets are thought to be more secure. They are less susceptible to hackers because they aren’t connected to the internet. But it also means you might lose your cryptocurrency permanently if you misplace your cold wallet.

Here are some examples of cold wallets:

Hardware Wallet is secured; you can protect your private keys from online exposure. Private keys for a hardware wallet are kept on a physical object, like a hard drive. A hardware wallet might be something you want to look into if you have a lot of cryptocurrencies.

Paper Wallets are sheets of paper filled with all the information needed to access your cryptocurrency. They also provide security by preventing the online disclosure of your keys. However, because it’s a paper document, you risk losing your money if you lose your paper wallet.

Understanding the dangers involved is crucial when deciding between a hot wallet and a cold wallet.

You can frequently get lost keys back with the help of a hot wallet. Typically, you can use them similarly to another password-protected account. You can frequently get back in if you know the right passphrases. You must, however, be prepared to accept the security risks.

If you use a cold wallet, you may not have as easy of a time recovering your funds. You might not be able to access your cryptocurrency assets if you lose the keys required to open your wallet. You might also lose your purchases if the hard wallet is lost or stolen without backup.

Creating a strategy that works for you is essential when storing your cryptocurrency. The ability to hold coins for trading may be helpful. For online transactions and moving your cryptocurrency around, you might also want a hot wallet. Given that cold wallets offer the highest level of protection, they may be your best choice for long-term storage.

Using Cryptocurrency

Coins or tokens is a name for individual cryptocurrency, depending on its use. Software programs like games and financial products, goods and services may use coins as stores of value or as units of exchange.

Although using bitcoin and other cryptocurrencies to make purchases in the real world is possible, most people shouldn’t, according to experts. The price you pay today might be significantly higher or lower tomorrow due to the volatility and fluctuation in the value of cryptocurrencies.

Cryptocurrency can be used to access blockchain networks like Ethereum and other networks that let developers create software and use it as an investment.

Additionally, crypto debit and credit cards linked to exchange accounts are available, enabling you to combine physical purchases with your cryptocurrency portfolio. You can pay online with cryptocurrencies even if you use PayPal.

However, investing is the most typical use of cryptocurrencies. Additionally, there are indications that such crypto investments will become more widely available. You can also invest your cryptocurrency in tax-advantaged retirement plans using self-directed IRA custodians that connect to an exchange like Coinbase.

Bitcoins and Altcoins

Bitcoin (BTC) continues to rule the cryptocurrency market, but there are a large number of alternative coins, or altcoins, that compete with it. Investors need a clear understanding of how each alternative to Bitcoin differs from Bitcoin and what it can add to a portfolio because many are available.

Bitcoin (BTC)

Bitcoin is a decentralized digital currency that can be purchased, sold, and exchanged without a mediator like a bank. In addition to being the first cryptocurrency, Bitcoin (BTC) is the most well-known of the more than 19,000 cryptocurrencies currently in use.

All cryptocurrencies besides Bitcoin are referred to collectively as altcoins (BTC). Because most cryptocurrencies are forked from one of Bitcoin or Ethereum (ETH), some people define altcoins as all cryptocurrencies other than those two. Some alternative coins attempt to set themselves apart from Bitcoin and Ethereum by offering new or additional capabilities or purposes. In contrast, others use alternative consensus mechanisms to validate transactions and open new blocks.

Most altcoins are created and published by programmers with different goals or purposes in mind for their coins or tokens. Find out more about alternative cryptocurrencies and how they differ from Bitcoin.

Following the creation of Bitcoin (BTC), altcoins provided a rival to the most well-known cryptocurrency. Altcoins now make up almost 80% of the cryptocurrency market. Additionally, there are currently more than 5,000 alternative coins in use. Contrarily, investing in altcoins is riskier than investing in more established cryptocurrencies like Bitcoin and Ethereum (ETH).

Ethereum (ETH)

Ethereum is the largest altcoin and the second-largest cryptocurrency after Bitcoin. Due to its potential for price stability, many investors no longer consider it an altcoin; it is more risk-adjusted than most altcoins and is very similar to Bitcoin.

Furthermore, Ethereum was the first blockchain to introduce smart contracts, which paved the way for decentralized finance (DeFi). In contrast to Bitcoin, which is primarily a transactional protocol, Ethereum is regarded as an actual money protocol.

Ethereum can also be used to lend, borrow, short, long, and other functions that are not possible on the base layer of Bitcoin. Unlike Bitcoin, Ethereum serves as a ledger on which platform users can create decentralized applications using their native tokens (ETH).

Tether (USDT)

Tether is also known as a stablecoin. These are virtual currencies linked to tangible assets, namely the dollar. The dollar was intended to be Tether’s benchmark. Tether’s price typically equates to $1, unlike the value of many other cryptocurrencies, which frequently fluctuate. This isn’t always the case, though, and fluctuations in tether price have alarmed investors in the past.

US Dollar Coins (USDC)

Dollar assets back a digital currency called USD Coin (USDC). One USDC coin has the same value as one US dollar, making USDC a tokenized representation of the dollar. Since it is a stablecoin, USDC should always have the same value.

Binance Coin (BNB)

The cryptocurrency known as Binance Coin, which trades under the symbol BNB, is a product of the Binance exchange. The ERC-20 token used to launch Binance Coin on the Ethereum blockchain served as its base before it was adopted as the native currency of Binance’s blockchain, the Binance Chain, in July 2017.

Binance USD (BUSD)

BUSD is a controlled stablecoin backed by fiat money and linked to the dollar. One dollar is kept in reserve for every unit of BUSD. In other words, there is a 1:1 supply-to-demand relationship between BUSD and the US dollar. BUSD is a stablecoin that seeks to maintain a constant market value. Without leaving the cryptocurrency market, it lets traders and investors keep a low-volatility asset on the blockchain.

How to Buy Cryptocurrency?

1. Select a cryptocurrency broker or exchange.

Selecting a platform to buy and sell cryptocurrencies is the first step if you’re interested in doing so. Typically, you have the option of using a traditional broker or a cryptocurrency-specific exchange.

- Traditional brokers: A few online brokers provide access to buying and selling cryptocurrency and other assets like stocks, bonds, and exchange-traded funds (ETFs). Although they typically have fewer crypto features, these platforms have lower trading costs.

- Cryptocurrency exchanges: You can pick from a wide variety of cryptocurrency exchanges, each with a different selection of cryptocurrencies, wallet storage options, interest-bearing account options, and more. Asset-based fees are standard on deals.

It’s a good idea to consider factors like supported cryptocurrencies, security features, fees, storage and withdrawal options, and educational resources as you evaluate various platforms.

2. Fund your account.

To start trading, you’ll need to fund your account after selecting a cryptocurrency exchange or online broker. However, credit card purchases of cryptocurrencies are particularly risky, and some businesses, like Coinbase, don’t support them. Several credit card companies also forbid cryptocurrency transactions. Since cryptocurrencies are highly volatile investments, it might not be a good idea to take on debt or incur high credit card transaction costs to purchase some of these investments.

3. Make a purchase

The majority of times, placing an order on the web or mobile platform of your broker or exchange only requires the click of a button. To purchase cryptocurrencies, you can select “buy,” pick an order type, enter the quantity, and then confirm the order. The same method is used for “sell” orders.

However, the order type you choose impacts the cost at which your order is fulfilled when it comes to transactions. Market orders, limit orders, and stop orders are the three main types of orders. Generally speaking, you’ll have the same order options at your disposal as if purchasing any other asset.

4. Choose a method of asset storage.

To prevent theft or hacking, you must store your cryptocurrency in a secure location after buying it. Wallets for cryptocurrencies can help with this. A crypto wallet is a physical item or piece of online software used to store your cryptocurrency’s private keys safely. Some exchanges make it simple to store funds directly through the platform by providing built-in wallet services. However, not all brokers or exchanges automatically offer you wallet services.

How to Make Money in Cryptocurrency?

You can still earn money online with a bit of luck and wise investing. There are various ways to make money with cryptocurrencies and generate income. Most crypto assets come with a high level of risk due to their inherent volatility, while others call for specific knowledge or expertise. Here are some basic strategies to earn income in cryptocurrency:

1. Investing/Buy and HODL

The long-term tactic of acquiring and holding cryptographic assets for some time is investing. With the majority of crypto assets, a buy-and-hold strategy works well. They have fantastic long-term growth potential but are short-term erratic. In this respect, investments like Bitcoin and Ethereum can be considered safe because of their track record of maintaining constant price changes. However, you are free to trade any asset that you think will appreciate in value; before deciding to hold onto an asset you purchase, you must conduct a study on it.

This method of income strategy with cryptocurrency is the best option for beginners. Buying a cryptocurrency and holding onto your tokens over the long term is known as “HODLing,” a play on the word “hold.” This is equivalent to purchasing and holding stocks for several months to years. And by doing this, you can avoid worrying about sudden price changes, especially if you invest in reputable and long-standing cryptocurrencies like Bitcoin and Ethereum.

Example: (Time Horizon is set to 1 day)

On May 12, 2022, you bought an Ethereum at $1,770 per token. A month later, the price of Ethereum had dropped to lows of $1,422.

$1,770 x 1 = $1,770

$1,770 – $1,422 = $348 (Php 19,973.79)

($448 / $1,770) x 100% = 19.66%

Had you panicked and sold your ETH tokens, you would have made a loss of approximately 20% or $348 (Php 19,973.79). However, by August 2022, Ethereum was trading at $2,020 per token.

$2,020 – $1,770 = $250 (Php 14,348.99)

($250 / $1,770) x 100% = 14.12%

Had you engaged in HODLing, you would have made a profit of approximately 14% or $250 (Php 14,348.99). This is just one example of many. The key point here is that a long-term strategy is the most effective way to invest in cryptocurrency.

2. Day Trading

There may be a similarity between trading and investing. However, there are differences based on time horizons. While investors may only make a small number of changes to their portfolios each year, traders aim to make a profit relatively quickly.

However, like stocks or other securities, day trading can be another way to profit from cryptocurrencies. To generate a quick profit, day traders acquire and sell many assets on the same day. Being unable to foresee how cryptocurrency values would alter over the course of a day or over time makes this a dangerous strategy. Any exchanging platform allows you to start day trading; you must sign up, purchase some assets, and conduct some analysis to get started.

Scalping is a popular day trading strategy aiming to make money from minute price changes. The idea is that by making small but consistent gains throughout the day, one will end up with significant returns. Scalpers profit by utilizing the increased trading volume. Scalpers frequently use automated bots to increase the frequency of their trading cycles, and they often exit a trade just seconds after entering it. Ideally, scalpers want to close out a position before any breaking news, or momentary fluctuation has a chance to alter the perception of a coin in the market.

Attribution: IG Bank

Advice: If you plan to day trade, think about becoming an expert at stock analysis using technical and fundamental analysis; these techniques are frequently used to assess all traded assets.

Example: (Time Horizon is set to 5 minutes)

On September 19, 2022, you bought an Ethereum at $1,285 per token at 07:05. At 08:15, you sold it for $1,305. You repeated the process of scalping for the rest of the day. Now, here is the illustration:

1st Scalping:

| Time | Buying Price | Selling Price |

| 07:05 | $1,285 | – |

| 08:15 | – | $1,305 |

Selling Price – Buying Price = Profit

$1,305 – $1,285 = $20 (Php 1,149.96)

2nd Scalping:

| Time | Buying Price | Selling Price |

| 09:30 | $1,290 | – |

| 10:40 |

– |

$1,317 |

Selling Price – Buying Price = Profit

$1,317 – $1,290 = $27 (Php 1,552.45)

3rd Scalping:

| Time | Buying Price | Selling Price |

| 13:25 | $1,313 | – |

| 14:40 | – | $1,370 |

Selling Price – Buying Price = Profit

$1,370 – $1,313 = $57 (Php 3,277.41)

4th Scalping:

| Time | Buying Price | Selling Price |

| 15:55 | $1,340 | – |

| 16:50 | – | $1,350 |

Selling Price – Buying Price = Profit

$1,350 – $1,340 = $10 (Php 574.96)

5th Scalping:

| Time | Buying Price | Selling Price |

| 18:20 | $1,325 | – |

| 19:35 | – | $1,361 |

Selling Price – Buying Price = Profit

$1,361 – $1,325 = $36 (Php 2,069.89)

6th Scalping:

| Time | Buying Price | Selling Price |

| 20:50 | $1,357 | – |

| 21:20 | – | $1,390 |

Selling Price – Buying Price = Profit

$1,390 – $1,357 = $33 (Php 1,897.44)

Total Profit = 20 + 27 + 57 + 10 + 36 + 33 = $183 (Php 10,637.17)

($183 / $1,285) x 100% = 14.24%

After the 6th scalping, you decided to call it a day. You profited a total of $185 (Php 10,637.17), approximately 14% of your initial cost ($1,285 or Php 73,883.57) of entering the market.

3. Staking

Staking is a method for confirming cryptocurrency transactions. If you are staking, you own coins but do not use them. Instead, you secure the currency in a digital wallet.

Your coins are then used by a Proof of Stake (PoS) network to verify transactions. You are rewarded for doing this. In a sense, you are lending the network coins. As a result, the network can continue to be secure and validate transactions. Your reward is comparable to the interest that a bank would offer you on a credit balance.

The number of coins you have agreed to stake determines how many transaction validators are chosen by the Proof of Stake algorithm. Because of this, it uses less energy than crypto mining and doesn’t require expensive hardware. To become a validator and stake independently on a PoS blockchain, an investor must own a certain minimum amount of a crypto asset. One well-known example is Ethereum. It is tough to get started because you need to own at least 32 ether (ETH) to stake Ethereum independently. Staking pools frequently charge platform fees, which will slightly lower your returns.

Investors lend their coins to the network through staking to uphold security and validate transactions. Additionally, you have the option of lending coins to other investors and earn interest on that loan. Numerous platforms enable crypto lending.

Example:

If you only have 3 ETH, you don’t have enough to take on the role of a validator. You can lock up your ETH in a staking pool for six months. Net of fees, the platform provides an annual yield of 5%.

6 months / 12 months = 0.5

5% / 0.5 = 2.5%

3 ETH x 2.5% = 0.075 ETH

Over the next six months, you could accumulate crypto rewards of 0.075 ETH. You then can either withdraw the money to access your winnings or continue to stake it and earn rewards.

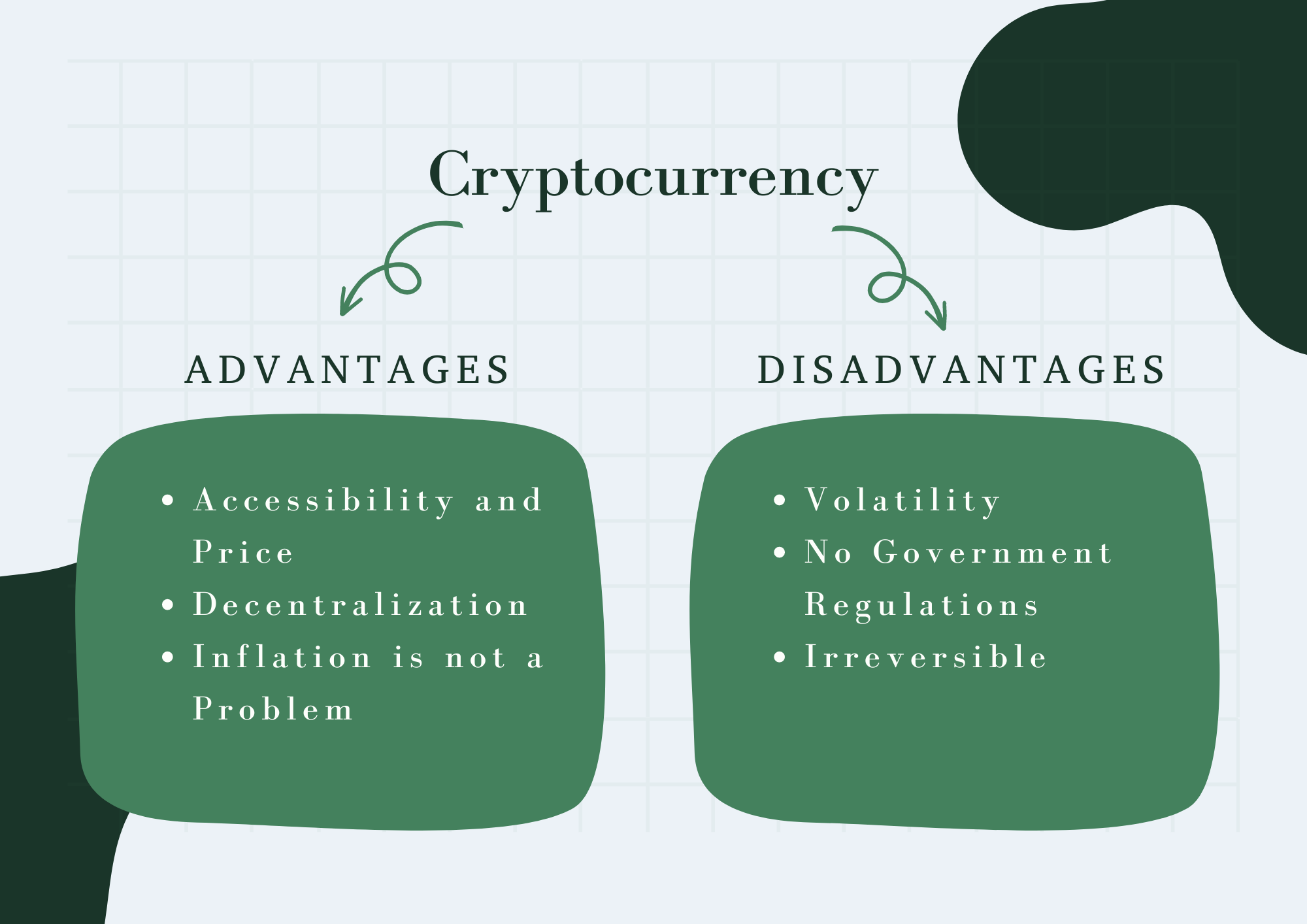

Advantages and Disadvantages

Cryptocurrency Advantages

Accessibility and Price

Like traditional currency, you can purchase using cryptocurrencies like Bitcoin. Even when moving money across borders, cryptocurrency transactions are already quicker and cheaper than traditional banking. This is because bureaucracy does not hinder cryptocurrencies. Additionally, there are systems for quick transaction verification (the miners or stakers) that operate around the clock. Additionally, there aren’t many maintenance and operating costs, at least not in comparison to banks. Due to the lack of outrageous fees, you can purchase expensive items, including luxury homes, for less money when using cryptocurrency.

Decentralization

As was previously mentioned, decentralization means that no one central entity, such as banks or governments, has control over your money. Decentralization safeguards you personally from outside interference and unauthorized asset freezing. But in a broader sense, decentralization transfers the financial sector’s power from financial institutions to users. Transparency in its operations is another benefit of decentralization. Because almost everyone uses the blockchain and maintains the system, transparency is essential.

Inflation is not a Problem

The cryptocurrencies do not belong to any particular economy or currency. Rather than national inflation, the global demand determines the price. But what about cryptocurrency inflation itself? For the most part, you can relax as an investor. There is no inflation because there is a limit on the number of coins, which prevents the supply from becoming out of control. This strategy prevents inflation regardless of whether a coin has an overall cap (like Bitcoin) or an annual cap (like Ethereum).

Cryptocurrency Disadvantages

Volatility

The cryptocurrency market is volatile. Cryptocurrencies’ values can change quickly depending on the state of the market, in contrast to conventional currencies, which generally have relatively stable values. An unstable currency is typically bad for business and everyday use, even though some people may benefit from it. Additionally, market volatility is frequently the cause of some people’s negative perceptions of cryptocurrencies. It’s not unheard of to experience the unpleasant sight of your cryptocurrency investments losing all of their value.

No Government Regulations

Decentralization and greater consumer control can be viewed as benefits, but they also have drawbacks. The increased responsibility that comes with transferring control from an institution to individuals is something few of us are ready or even willing to accept. For instance, you could lose everything very quickly if you misplace your crypto address or unintentionally share your private key with someone. Banks and other institutions have systems to guard against mistakes like that. Still, because cryptocurrency puts the burden of safekeeping on the user, it’s simple for things to spiral out of control.

Irreversible

Another drawback of crypto transactions is their lack of security because they are anonymous and unregulated. Nothing can be done if the wrong amount or recipient is sent because transactions made using cryptocurrencies are irreversible and final. Furthermore, there is a possibility of loss. Many crypto users decide to keep their investments in cryptocurrency wallets, which increases the likelihood of losing money if they misplace their private keys. Your cryptocurrencies might become inaccessible or disappear entirely in minutes if a hard drive crashes or a virus corrupts your data or wallet.

Important Terminologies

Address – Coin identification numbers specific to each cryptocurrency transaction. Consider the address as a “path” your cryptocurrency will take to reach a particular wallet. Any cryptocurrency transaction requires a wallet and an address. Your cryptocurrency will arrive at the wallet using the address which serves as the destination.

Altcoins – Abbreviation for Alternative Coins. Thousands of cryptocurrencies have appeared since the Bitcoin model first became successful. This phrase implies that there is only one “main” coin, with all others serving as merely “alternatives.”

Bitcoin – There are two possible meanings for this. “Bitcoin” with an uppercase “B” is the ledger of the cryptocurrency, while “bitcoin” with a lowercase “b” is the cryptocurrency itself.

Blockchain Technology – This is the system that operates a cryptocurrency. The users manage the system themselves, it is a safe unchangeable record keeper that authenticates the entire cryptocurrency system.

Crypto Mining – This is the transaction confirmation on a cryptocurrency’s blockchain. The blockchain already includes this procedure. Anyone who helps to validate new transactions, such as mine, is typically compensates additional cryptocurrency.

Crypto Wallet – Crypto wallet contains your crypto coins , whether it is real or virtual. Hardware and software wallets possibly controls cryptocurrency.

DeFi – Decentralized Finance, short for the phrase, is an umbrella term for any cryptocurrency-based substitute for conventional financial operations like money transfers, currency conversion, payment processing, and more.

Key – Two keys, public and private, form the basis of your cryptocurrency wallet. The public key confirms that the private key signed the transaction. On the other hand, the private key does the verification of ownership of specific cryptographic assets.

Ledger – You can view all transactions verified on the blockchain in this public record.

NFT – Non-Fungible Tokens, as their name suggests, are essentially immutable blockchain-based proofs of ownership. Over the crypto sphere, transactions for goods like music, art, and collectibles uses NFTs.

Recovery Seed – The security questions for your online accounts are analogous to your recovery seed. In an emergency, it is a string of letters and numbers that can prove you are the rightful owner of a wallet.

Tokens – Tokens is a possible form of cryptocurrency itself. They are cryptocurrency denominations produced “on top” of the blockchain. They can create or carry out things like smart contracts and decentralized apps and facilitate transactions.

MUST-READ AND SHARE!

2023 Your Practical Wedding Guide

Your Ultimate Access to Kuwait Directories in this COVID-19 Crisis

Investments and Finance Ultimate Guide

OFW FINANCE – Money News Update that you need to read (Table of Contents)

A Devotional for having a Grateful Heart

Stock Investment A Beginner’s Guide

How To Save Money Amidst Inflation

Philippines Best Banks with High-Yield Savings Return

Essentials Before Applying For a Credit Card

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.