No products in the cart.

Financial, Family And Children, Millennial, Working class

Top 5 Best Home Loan Options in the Philippines

Top 5 Best Home Loan Options in the Philippines

Financing your dream home into reality can be pretty expensive, especially now that the inflation in our country has also affected real estate prices. We can’t deny that buying a home in our country will take a lot of time, work, and, of course, a massive amount of money. But where will you get the right amount to buy your dream home while you’re still young? This is where housing loans enter the picture.

Minutes to read: 8 minutes

Age Bracket: 26 – 40 years old

Housing loan offers are available in the Philippines. A pretty massive amount of offers will be shoved in front of you when you need one. Choosing the right offer that suits you best will be the challenging part. Furthermore, knowing what you’re about to grab is essential. Do you have an idea about the housing loan rates? Terms? Amounts? How about its terms and conditions? If your answer is no, this article is just for you.

What is a home loan?

A home loan, also known as a mortgage, is a financial product offered by banks, real estate developers, and government agencies like the Pag-IBIG Fund. It provides borrowers with funds to buy or improve a home, usually with lower interest rates and repayment periods ranging from 3 to 30 years.

Key Considerations Before Applying

Before taking out a home loan, consider these factors:

- Compare Loan Offers: Assess down payment requirements, interest rates, and repayment terms.

- Affordability: Ensure monthly payments fit your budget.

- Loan Term: Longer terms mean smaller payments but higher total interest costs.

- Interest Rates: Choose between fixed and variable rates based on financial stability and risk tolerance.

.

Where can I apply for a home loan?

Many housing loan options will be gathered in front of you once you need one. Finding it may be easy, but choosing where you’ll apply will be difficult. If you haven’t thought about it yet, here are some of the housing loan options in the country.

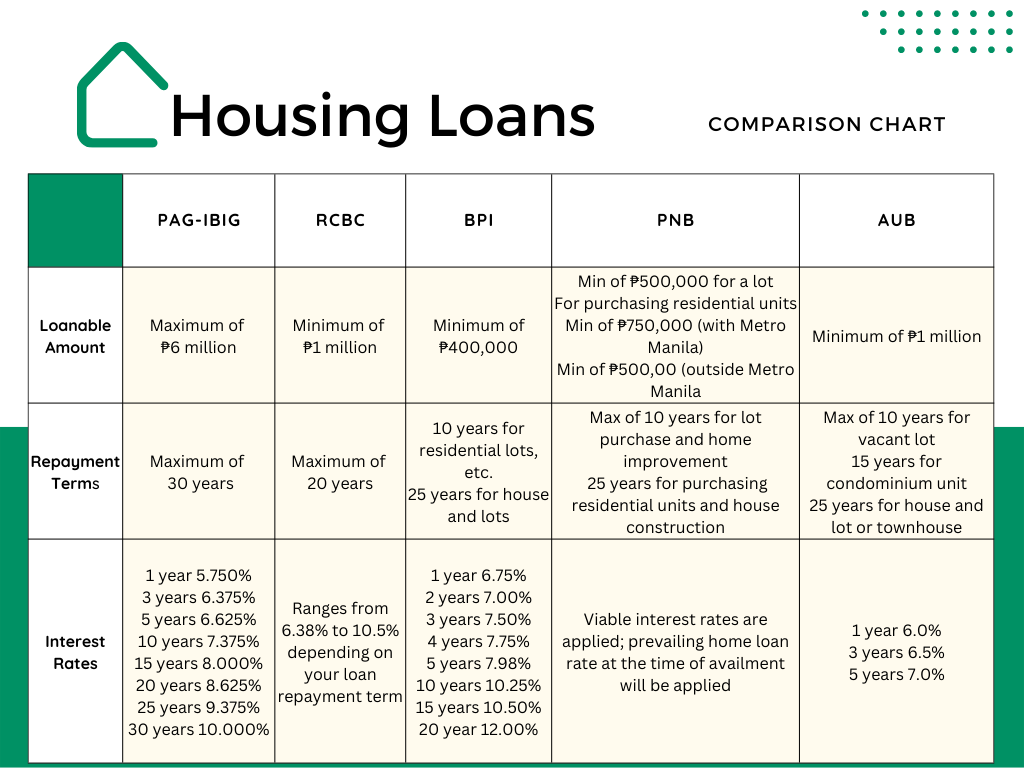

1. Pag-IBIG Housing Loan

A government-backed loan with affordable interest rates and flexible terms, ideal for Pag-IBIG members looking for low-cost home financing.

| Pag-IBIG Housing Loan Fixed Interest Rate | |

| 1 year 5.750%

3 years 6.375%

5 years 6.625%

10 years 7.375%

15 years 8.000%

20 years 8.625%

25 years 9.375%

30 years 10.000% | |

Qualifications:

- At least 24 months of Pag-IBIG membership savings.

- Age between 21 and 65 at the time of application, not exceeding 70 at loan maturity.

- No outstanding Pag-IBIG Short-Term Loan or foreclosed properties.

Requirements:

- Housing Loan Application Form with recent ID photo.

- Proof of income.

- Photocopy of valid IDs.

- Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT).

- Updated tax declaration and real estate tax receipt.

- Vicinity map of the property.

If you wish to read more, visit Pag-IBIG Housing Loan.

2. RCBC Home Loans

Offers competitive rates and flexible repayment terms, suitable for employed individuals with stable income.

Qualifications

- Age should be at least 21 years old at the time of the application

- Age should not exceed 65 years old at the time of loan maturity

- Must be a Filipino or a Dual Citizen

- If the applicant is a foreigner, must be married to a Filipino Citizen

- Must have an active mobile number and a residence/office landline

- If employed, must be working for at least one (1) year

- Must have a gross monthly income of at least ₱40,000

- If the applicant is an OFW, must be working abroad for at least two (2) consecutive years.

- If Self-employed, the business must be a profitable operation for at least two (2) years.

Requirements

- Accomplished RCBC Home Loan Application Form

- Copy of Transfer Certificate of Title (TCT) and Tax Declaration (Land and Improvement)

- Bill of Materials (For construction)

- If the applicant is employed

- Two (2) valid government-issued IDs

- TIN

- Utility Bill

- Certificate of Employment (COE) or latest ITR

- If the applicant is Self-employed

- Audited Financial Statements

- Business Registration with DTI

- ITR or Bank Statements

For more information, read more at Apply for an RCBC Home Loan today

3. BPI Housing Loan

Provides a step-up payment option, allowing borrowers to start with lower payments that gradually increase over time.

| Fixed Period | Fixed Interest Rate |

| 1 year | 6.75% |

| 2 years | 7.00% |

| 3 years | 7.50% |

| 4 years | 7.75% |

| 5 years | 7.98% |

| 10 years | 10.25% |

| 15 years | 10.50% |

| 20 years | 12.00% |

Qualifications

- Must be a Filipino citizen

- If the applicant is a foreigner, must be married to a Filipino citizen or with a resident visa

- Must be at least 21 years old, but age should not exceed sixty-five (65) years old upon loan maturity

- Combined household income must be at least ₱40,000

Requirements

- Housing Loan Application Form

- Two valid government-issued IDs

- Duly accomplished housing loan application form

- Income Documents

- If employed

- Certificate of Employment (COE)

- Latest Income Tax Return (ITR) for the last 2 years

- If OFW

- Certificate of Employment (COE) or contract authenticated by the Philippine Consulate

- If seaman, Crew Contract and Exit Pass validated by Philippine Overseas Employment Administration (POEA)

- Proof of monthly remittances

- Notarized or Authenticated Special Power of Attorney

- If Self-employed

- DTI Registration

- Income Tax Return (ITR) with statement of assets and liabilities for the last two (2) years

- Bank statements for the last six (6) months

- Articles of incorporation and By-Laws with SEC Registration Certificate

- Audited Financial Statement for the last 2 years

- If Practicing Doctor

- Clinic Address/es and schedule

- Collateral Documents

- Clear copy of owner’s duplicate copy of Transfer Certificate of Title (TCT) or Condominium Certificate Title (CCT)

- Location or vicinity map of the lot plan certified by a licensed Geodetic Engineer

- Photocopy of Tax declaration/Tax Receipts/Tax Clearance

- Endorsement Letter/Computation Sheet/Contract to Sell from developer stating the contract price (for accredited developer/project)

- If employed

Upon submission of complete and accurate requirements, processing time of your loan application will be around two to five (2 – 5) days. If you need more information, read more at BPI Loans.

4. PNB Housing Loan

A reliable home loan with variable interest rates, offering financing options for both Metro Manila and provincial properties.

Qualifications

- Must be a Filipino Citizen

- Must be at least 21 years old, but age should not exceed 65 years old upon loan maturity

- Must be employed or self-employed

Requirements

- Duly accomplished Housing Loan Application Form

- Photocopies of two (2) valid government-issued IDs

- A non-refundable appraisal fee worth ₱3,500

- If applying with a co-maker/co-borrower/attorney-in-fact, a separate application form is needed

- Income Documents

- If Employed

- Photocopy of latest Income Tax Return (ITR)

- Certificate of Employment (COE) and Compensation

- Alien Certificate of Registration (ACR) and Official Receipt (if resident alien)

- If Self-employed

- SSS/GSIS/Driver’s License/PRC License

- Business Name (DTI) or SEC Registration

- General Information Sheet

- Financial Statements or Income Statements for the last three (3) years

- Photocopy of the Income Tax Return (ITR) for the last three (3) years

- Articles of Incorporation, By-Laws with SEC Registration Certificate and latest General Information Sheet if applicable

- List of Trade References (Suppliers / Customers)

- If Practice of Profession

- If Doctor, clinic Address/es, schedule, and contact numbers

- Bank Statements for the last six (6) months

- If OFW

- Photocopy of Passport

- Certificate of Employement (COE) or Contract approved by POEA. If direct hired, must be authenticated by the Philippine Consulate

- Proof of inward remittances through PNB or other banks

- If Seafarer, Crew contract and Exit Pass from POEA

- PNB prescribed Special Power of Attorney (SPA), (only if applicable)

- If the SPA was executed and notarized abroad, it should be authenticated by the Philippine Consulate

- Collateral Documents

- Two (2) sets of clear photocopy of all pages of the Transfer Certificate of Title (TCT)/Original Certificate of Title (OCT) /Condominium Certificate Title (CCT)

- Vicinity Map or location of the Lot Plan certified by a licensed Geodetic Engineer

- Photocopy of the latest Tax Declaration / Realty Tax Receipts / Tax Clearance

- For condominiums, Master Deed of Declaration and Restrictions

- For Construction and Renovation Purposes:

- Complete set of building plans duly signed by a Civil Engineer or Architect

- Bill of Materials, Specifications, or Cost Estimates duly certified by a Civil Engineer or Architect

- For renovation, scope of work

- Building Permit

- For Purchase of lot or house and lot, Deed of Absolute Sale or Contract to Sell

- If Employed

To know more about PNB Housing loan, read more at PNB Housing Loan.

5. AUB Home Loan

Features an interest rate cap, ensuring borrowers are protected from sudden market fluctuations while securing home financing.

| Fixed Period | Fixed Interest Rate |

| 1 year | 6.0% |

| 3 years | 6.5% |

| 5 years | 7.0% |

Requirements

- Duly filled out and signed home loan application form

- Photocopy of two (2) valid government-issued IDs each from the principal borrower and co-borrower

- Photocopy of Marriage Contract or CENOMAR, whichever is applicable

- Income Requirements

- If Employed

- Photocopy of Certificate of Employment (COE)

- Photocopy of the latest three (3) month payslip

- Photocopy of latest Income Tax Return (ITR) or BIR Form 2316

- If Self-Employed

- Company or Business Profile

- Photocopy of Business Registration Papers

- Photocopy of the latest three (3) months bank statements

- Photocopy of Audited Financial Statement for the last two (2) years

- Photocopy of the latest Income Tax Return (ITR) for the last two (2) years

- List of the major trade suppliers and customer with their contact details (if applicable)

- Collateral Documents

- Contract to sell

- Photocopy of Title (TCT)/Condominium Certificate Title (CCT)

- Photocopy of the Vicinity Map/ Lot Plan/ Subdivision Plan

- Photocopy of the updated Tax Declaration, Tax Receipts, and Tax Clearance

- For Accredited Developers, statement of account, reservation agreement/ contract to sell.

- If Employed

For the complete set of information regarding the AUB Home Loan, visit their website at AUB • Loan Products • Home Loans

Final Thoughts

Given that I made this guide just for you, do not limit yourself to the options that I have given you. There may be a lot of housing loan offers out there, but be keen on finding the perfect one to finance your home. It may be difficult for you, especially if this is your first time, but you can use this guide as your reference.

A lot of financial services are available for everyone. Even if your goal is to finance your dream home, it doesn’t mean you just have to settle for home loans. Other financial products, such as personal loans, can be a great alternative, especially if you just need a small amount to finance more minor housing needs. Just do your research and look for a loan to get the right amount you’ll need.

Other financial institutions also offer home loans, so do not limit yourself to bank loan offers. See which offers the better loan amount, better repayment term, and lower interest rate. Talk with a trusted finance officer or consult a real estate professional. This way, you can be more knowledgeable about the loan you’re planning to apply for, and it helps you make the best-informed decision possible.

MUST-READ AND SHARE!

2023 Your Practical Wedding Guide

Your Ultimate Access to Kuwait Directories in this COVID-19 Crisis

Investments and Finance Ultimate Guide

OFW FINANCE – Money News Update that you need to read (Table of Contents)

A Devotional for having a Grateful Heart

Stock Investment A Beginner’s Guide

How To Save Money Amidst Inflation

Philippines Best Banks with High-Yield Savings Return

Essentials Before Applying For a Credit Card

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.