No products in the cart.

Financial, Millennial

The Best E-Wallet Apps for a Cashless Lifestyle in the Philippines

Top 5 Mobile Wallets to Use on a Daily Basis

In the past years, since the internet has overcome our country, a lot of things have changed. We have welcomed many trends from foreign countries, innovative household items, and different gadgets; now, even our mode of payment has increased. Remember the days when our wallet was the most important thing we should not forget whenever we left home since we had to pay for everything using cold cash? But not anymore. You’re good to go as long as you have your phone.

Minutes to Read: 5 minutes

Age Bracket: 21 – 40 years old

Filipinos have embraced the convenience of the internet, including online payments. Banks may have adopted the online form, but it is not accessible to every Filipino. That is why the use of E-Wallets has been introduced. It is way more convenient for everyone, and it doesn’t need a lot of documents to have one. Easy to use and always on the go. If you’re planning to go cashless now, here are some options you have to check out.

What is an E-wallet?

According to Juniper Research, digital wallet users will probably reach 5.2 billion worldwide by 2026. This is a huge number and will continue to grow since we can see how popular digital wallet is now. One of the countries with rapid growth in the use of digital payments is the Philippines. Due to the rise of eCommerce and the popularity of e-wallets and online banking in the country, the adoption and use of digital wallets will possibly reach 75% of the population.

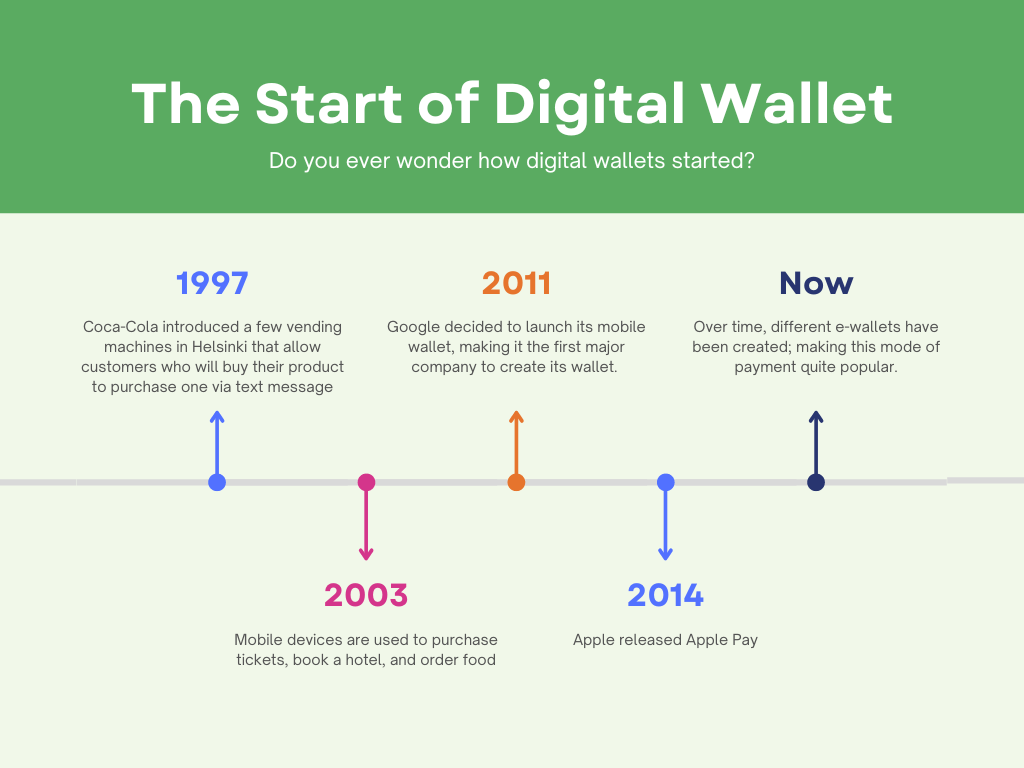

Do you ever wonder how digital wallets started with these quick user increases? The start of digital payments began in 1997 when Coca-Cola introduced a few vending machines in Helsinki that allow customers who will buy their product to purchase one via text message. It may not be as innovative as it is now, but the idea of using your mobile device to transact was a start. Years passed, and this idea continued. Mobile devices are used to purchase tickets, book a hotel, and order food by 2003.

In 2011, Google decided to launch its mobile wallet, making it the first major company to create its wallet. However, it can only be accessed using one phone model and was only accepted by a few merchants. But this was a start since, by 2012, Apple introduced Apple’s Passbook, where you can store your tickets and boarding pass on your phone. It may not be a mobile wallet, but Apple has used it as a stepping stone since Apple Pay was released two years later. Over time, different e-wallets have been created, making this mode of payment quite popular.

An E-wallet, a mobile wallet, or a digital wallet is a financial transaction application that you can download on a mobile device that carries your digital information and allows you to make payments digitally or virtually. With this application, you don’t have to worry about taking your wallet with cash and cards since you can now store everything on your E-wallet. All you have to do is enter your credit/debit card or bank account information, and it will keep it so you can use it anytime you have to pay for your purchases. Other than that, E-wallets can also be used to transfer or receive money from one account to another. This process is called a money transfer.

What is the most used e-wallet?

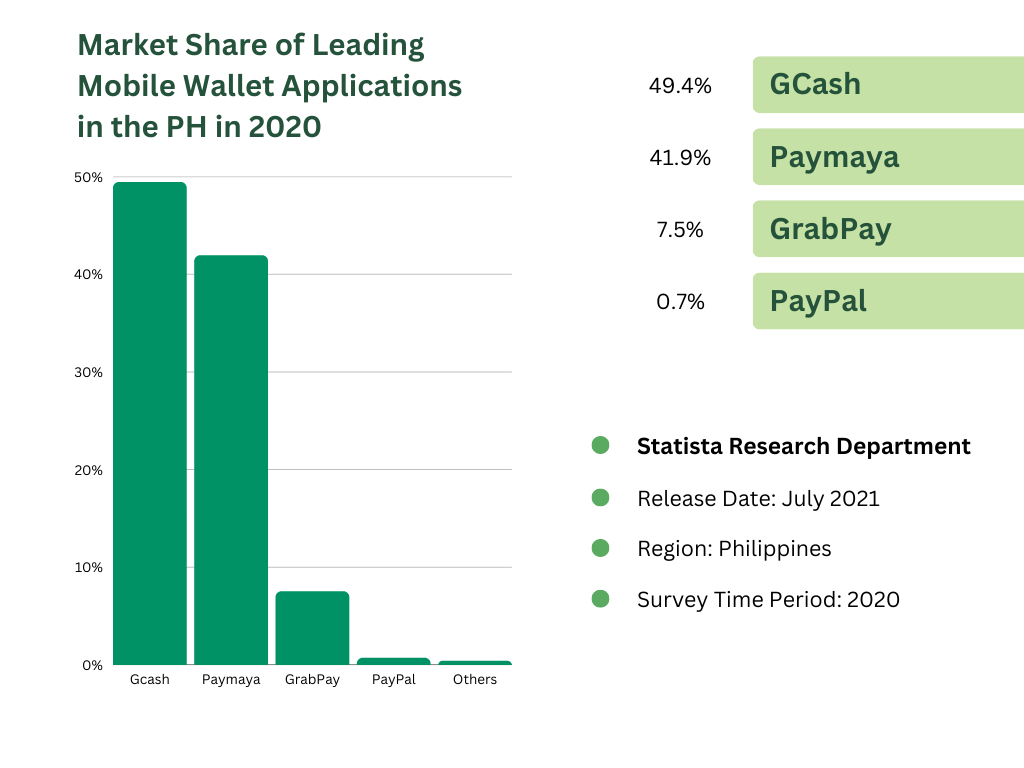

Due to the limited person-to-person interactions and transactions in purchasing services amidst the pandemic, the interest in the use of digital payments has increased among Filipino consumers. Some may still prefer using cash as their mode of payment, yet a lot have converted to paying digitally, which caused the growth of e-wallet users in the country. Based on the survey conducted in 2020 by Statista Research Department, Gcash is the leading mobile wallet application based on its market share.

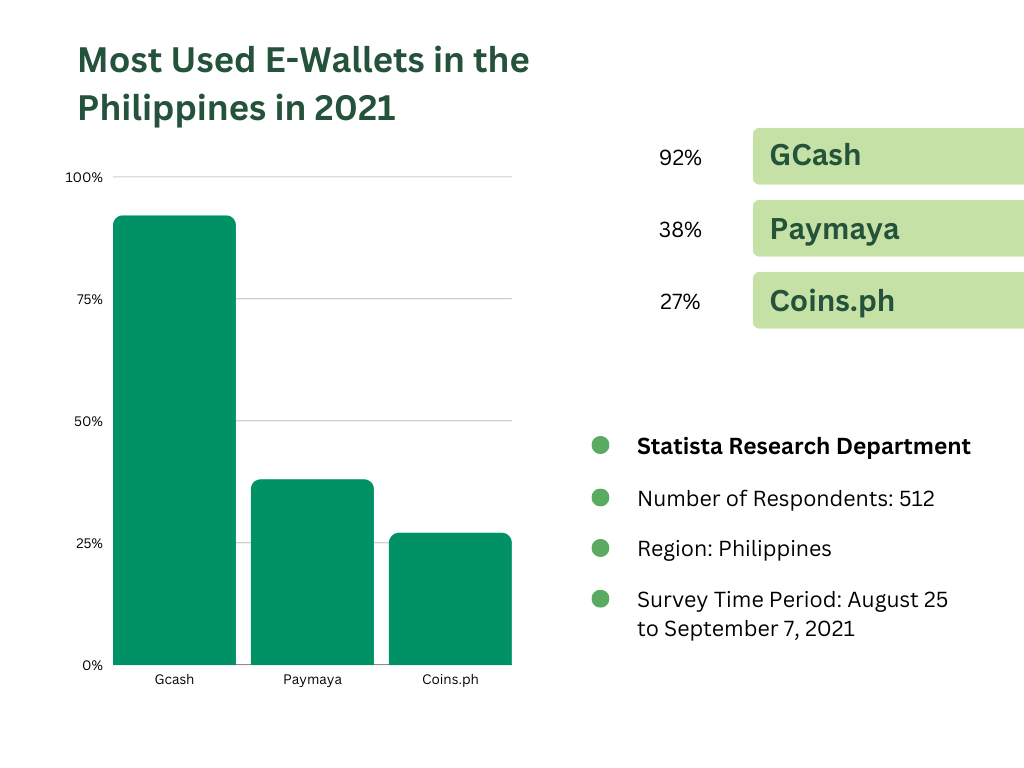

Additionally, when an online survey was conducted again from August to September 2021 with 512 respondents on an online survey, it showed that Gcash is the most used wallet in the country, followed by Paymaya as the second.

Gcash

If you’re looking for an all-in-one e-wallet, Gcash is the right fit for you. It is the most versatile wallet in the Philippines, and the verification is quick and easy. This is almost available to use as an online payment anywhere in the Philippines, from in-store malls to sari-sari stores! If you’re a student looking for an e-wallet that you can use but worried about a valid ID for verification, Gcash got you! All you need is your School ID, send a ticket for verification, and you’re all done. Registration is open to all mobile networks, so you don’t have to worry if you don’t own a Globe number.

What can you do with Gcash?

- Express Send / Transfer Money – Send money to another Gcash user with no fees! However, if you transfer money to Gcash’s partner banks, the transaction costs ₱15.

- Withdraw Cash – If you plan to withdraw your cash on your Gcash account, you can cash out your money through any partner outlet or withdraw it from any Bancnet ATM using your GCash Card.

- Pay Bills – the app will allow you to pay your bills in a few taps. May it be for utilities, government, credit cards, loans, or even tuition fees.

- Buy Load – top up your prepaid load by buying on Gcash and earn a 5% cashback on your load purchases.

- Save Money – saving is a whole lot easier with Gcash. With no maintaining balance and a 3.1% interest rate on your savings.

- GCredit – a credit line with a “shop now, pay later” feature within the app that you can access when you raise your GScore to a certain level.

- GInvest – the best place for beginners to invest in different investment funds within the app.

- GLife – a shopping experience inside the app where you can order food and shop online. Use Gcash as your payment option for an easier process of your payment.

- GInsure – being financially secured can now be accessed with GCash, which allows users to access various insurance offers that provide cash assistance and medical coverage.

Maya

Are you fond of cash rebates or cash backs? Then download the Maya app now! Maya, formerly known as Paymaya, is generous with giving you cash rebates on your purchases. May it be load purchases, dining, or shopping purchases. It is an equally capable digital wallet, just like GCash, that provides essential services with the same convenience. After successfully opening and verifying the account, Paymaya will give you access to a virtual card empowered by either Visa or Mastercard that you can use on your online purchases to make your online shopping experience more convenient.

What can you do with Maya?

- Send Money – Send money to another Maya user with no fees! However, if you transfer money to Gcash’s partner banks, the transaction costs ₱15.

- Buy Load and Gaming Pins – purchase prepaid loads and data bundles for all networks and enjoy unlimited cashback. You can also purchase your gaming pins and lifestyle items at a discounted price.

- Pay Bills – the app will allow you to pay your bills in a few taps. May it be for utilities, government, credit cards, loans, or even tuition fees.

- Maya Savings – saving is now more effortless when you deposit it in your Maya Savings that you can access within the app and earn a 4.5% interest rate per annum.

- Buy-Sell-Hold Crypto – cryptocurrencies are now available to everyone within the Maya App, where you can buy and trade digital currencies.

- Maya Credit – a low-cost credit line you can use to cash in, pay bills, buy loads, and more.

- Lifestyle – purchase travel tickets, food, shop, and more inside the app.

Coins.ph

Coins.ph might be the perfect fit for you if you’re into digital currencies. Access bitcoin and other digital currencies inside the app and do basic online transactions that you can expect in a digital wallet. Coins.ph is the only e-wallet in the country powered by blockchain technology that can hold both electronic money and virtual currency, making it the best application you can use if you’re planning to deal with cryptocurrencies. You can purchase loads for your travel necessities, such as beep card and EasyTrip, in just a few clicks.

What can you do with Coins.ph?

- Send / Receive Money – send money to your friends with only their email address, Facebook Name, or bank account details. You can also send a payment request to anyone if you’re waiting to receive payments.

- Pay Bills – instantly pay all your bills on your app. May it be utilities, government, telecom, or credit card.

- Buy Load – buy load to all networks effortlessly and faster on your Coins.ph app and instantly subscribe to various load promos.

- Buy Game Credits – Access and purchase game credits such as gift cards, credits, shells, and more.

- Buy Digital Currency – convert your peso into various digital currencies that you want. May it be Bitcoin, Ethereum, or more.

Grabpay

As the name suggests, the company behind GrabPay is Grab. So, if you’re a frequent customer of grab and use it regularly, it’s best to use their GrabPay as your convenient payment option and earn rewards and promos. If you think you can only use it within Grab, you can also use this digital wallet outside the Grab App to pay your monthly bills, purchase prepaid loads, pay for your online and in-store purchases, and more.

What can you do with GrabPay?

- Pay for Grab – use it as a payment option when you use Grab services for convenience and effortless transactions.

- Pay for In-store Purchases – use it to pay for your in-store purchases on Grab’s partner stores.

- Pay for Online Purchases – use it to pay for your online purchases on Grab’s partner sites and apps.

- Pay Bills – pay your bills instantly inside the Grab app. May it be a utility bill, telecom, government, and more.

- Buy Load – purchase mobile load for Smart, Sun, TnT, Globe, and soon, ™.

- Transfer Money – transfer your money to any local bank and GrabPay Wallets free of charge.

Paypal

A PayPal account is a must-have if you’re a freelancer that plans to work with foreign clients. PayPal is an online payment system used worldwide that allows you to quickly receive payments from abroad and pay for your international subscriptions and purchases conveniently. It is one of the most prominent digital platforms that allow multi-currency for over 200 countries. Shopping online and using PayPal as your payment option is much safer with their Buyer Protection Feature, which lets you refund your return shipping with their refund return service.

What can you do with PayPal?

- Send Money – you can securely and quickly send money to anyone, anywhere. Sending can also be flexible since you can send money with a credit card (with a 2.9% fee), a bank account, or your PayPay balance.

- Receive Money – you can create your unique PayPal.Me Link or QR code that you can share with your friends or client whenever you need the money.

- Shopping – use PayPal as your payment option when you shop, whether in-store or online. You can also choose your payment option through PayPal: Pay with QR Code, Rewards, Buy Now Pay Later, or check it out with crypto. The choice is yours.

- Link your account – link your cards and bank accounts on your PayPal account as your other payment options to quickly and conveniently track your e-money no matter how much you spend.

- Cryptocurrency – buy, sell, and transfer cryptocurrency using your PayPal app and start with as low as $1. You can also learn things about digital currency at your own pace with their latest articles if you’re a beginner.

- Donation – give or receive donations via PayPal. Setting up for fundraising or a campaign is accessible and easy on PayPal if you’re a person in need of financial support.

MUST-READ AND SHARE!

2023 Your Practical Wedding Guide

Your Ultimate Access to Kuwait Directories in this COVID-19 Crisis

Investments and Finance Ultimate Guide

OFW FINANCE – Money News Update that you need to read (Table of Contents)

A Devotional for having a Grateful Heart

Stock Investment A Beginner’s Guide

How To Save Money Amidst Inflation

Philippines Best Banks with High-Yield Savings Return

Essentials Before Applying For a Credit Card

Credit Card Starter Guide for Beginners

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.