No products in the cart.

Financial

The Ultimate Guide to Seamless E-Payments: Embracing Contactless Transactions Amidst the Pandemic

The Ultimate Guide to Seamless E-Payments: Embracing Contactless Transactions Amidst the Pandemic

Due to its incredible ease, electronic payments and e-payment systems have continuously improved over the past few decades. Businesses have begun to adopt electronic/contactless payments as consumer adoption has exploded, with the need for and advantages of electronic payments becoming even more clear in the wake of the COVID-19 pandemic.

Your business can minimize risk, boost control, expand visibility, and pay vendors more promptly by switching to electronic payments. There is a reason why e-payments are being used by thousands of middle-market companies to pave the way for a paperless accounts payable future.

Mins to Read: 17 minutes

Age: For all

Contactless payments

What is contactless payment?

Contactless payments are made by swiping a contactless chip card, a mobile device, or a wearable device across a payment terminal that supports the technology. The same contactless technology is used by cards, phones, watches, and other gadgets. The checkout process is safe, practical, and touch-free when you tap to pay.

What are Electronic Payments?

Electronic payments, sometimes known as e-payments, are a technique to conduct business or settle accounts via the internet or other electronic media without using actual checks or currency. Credit cards, debit cards, virtual cards, and ACH are the most widely used electronic payment systems (direct deposit, direct debit, and electronic checks). For instance, paying a vendor online with a credit card, debit card, or another method when they provide a service for your company is referred to as an electronic payment. The majority of electronic payment solutions eliminate the hard costs and fees connected to conventional B2B payments like checks, including those related to paper, postage, and physical labor.

How does a contactless e-payment account work?

E-payment accounts operate in one of two ways.

You can either:

- Pay money into your e-money account via a credit or debit card (money is taken out of your balance when you make an online purchase or added to it if you sell anything), or

- Connect your payment card and e-wallet. Nothing is in your account. (When you make an online purchase, the e-payment provider charges your card or, if you’re a seller, pays your card.)

How to use an e-payment company

Choosing an e-payment provider is the first step. PayPal, Apple Pay, and Google Pay are common options.

The majority of businesses will ask you to:

- Create an account by entering your information and following the steps.

- Add a bank card by providing your credit or debit card information.

After registering, you can use the information associated with your new account to make purchases.

Advantages of contactless e-Payment?

Both businesses and their suppliers greatly benefit from contactless payments and e-payments systems. E-payments are advantageous in the context of accounts payable because, when compared to conventional checks, they lower costs, enhance relationships, increase visibility, and provide more security. This is how:

- Time-Saving: The more transactions a company can handle electronically, the less time and money it will spend printing, signing, stuffing, and mailing checks. In fact, switching to a comprehensive e-payments strategy can cut costs associated with payment processing by as much as 80%. You no longer need to wait in a huge line to withdraw money from an ATM or a bank branch thanks to electronic payment systems. Additionally, there are less people in line at the checkout counters, and transactions are completed faster. These online payment methods can also be used to pay for a wide range of goods on online retailer websites, negating the need to physically visit stores.

- Moneyless Society: Companies can strengthen their vendor relationships by enabling speedier, more secure payments that provide detailed remittance information for simpler reconciliation. By lowering the need for cash, e-payments also contribute to the development of a cashless economy, particularly in the nation’s urban areas. Banks can disburse more cash in rural areas of the country where e-payments are rare thanks to the decline in cash use in urban areas.

- Increased Payment Security: Compared to paper checks, electronic payments are naturally more safe, and specific payment options like virtual cards provide even higher fraud protection. In addition, best-in-class e-payment systems have extra features and safeguards that contribute to the security of the transaction process. However, security protocols that are built into electronic payment systems guarantee the safety of your money. To safeguard your money from loss or fraudulent activity, banks utilize highly secure procedures including two-factor authentication, PINs (Personal Identification Numbers), and OTPs (One Time Passwords).

- Efficient: E-payment solutions give your company better access to payment statuses, financial KPIs, and precise audit trails. They also lessen the expense and likelihood of data entry errors.

Types of Electronic Payments

Although there are many distinct kinds of electronic payments, the majority of e-payments fall into the following categories.

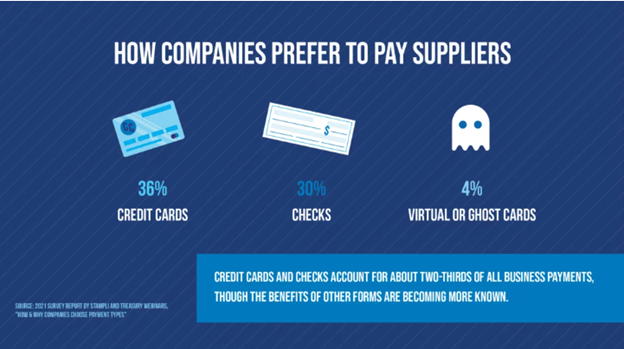

- Card Payments: The most popular kind of electronic payments are made using credit and debit cards. Credit card payments remain the most common electronic payment method due to their rewards and rebates programs, despite their declining appeal among younger generations.

- Payments made via bank transfer: There are several ways to transfer money between banks via a bank transfer. The majority of bank transactions take place through direct deposit, in which money is electronically put into the account of the recipient. However, ACH transfer payments are used in the US for bank transactions.

- Virtual Card Payments: A virtual card is a 16-digit number that is generated at random and can only be used to charge a single transaction for the amount indicated. Virtual cards ensure safe payments that are unbreakable as a result.

- FX payments and cross-border payments: enable companies to transfer and receive money worldwide. Wire transfers, forward contracts, currency exchange transactions, among other methods, are used in this procedure. Businesses who do business with foreign clients and suppliers will particularly benefit from this.

Preferred Contactless Payment Methods in Philippines

- GCASH

- PAYMAYA ENTERPRISE

- UNIONBANK UPAY

- JUSTPAYTO

- DISKARTECH

- ATM GO

- RCBC DIGITAL

- PEARLPAY

- GRABPAY

- NEXTPAY

- PAYMONGO

- TAXUMO

- MLHUILLIER WALLET

- COINS.PH

- MONEYGEMENT

- PAYPAL

- BAYAD CENTER

- CLIQQ BY 7-11

The Pros and Cons of Different Contactless Payment Types

- Credit Cards

You can select your favorite technique of doing online transactions now that you are aware of what an e-payment is and its many varieties. You can also use the mobile wallet or app provided by your bank to carry out secure, simple transactions online.

MUST-READ AND SHARE!

2023 Your Practical Wedding Guide

Your Ultimate Access to Kuwait Directories in this COVID-19 Crisis

Investments and Finance Ultimate Guide

OFW FINANCE – Money News Update that you need to read (Table of Contents)

A Devotional for having a Grateful Heart

Stock Investment A Beginner’s Guide

How To Save Money Amidst Inflation

Philippines Best Banks with High-Yield Savings Return

Essentials Before Applying For a Credit Card

Credit Card Starter Guide for Beginners

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.