No products in the cart.

Financial, Financial Literacy, Investment

8 Credit Card Essentials Before Applying

Essential Things to Take Note of Before Applying For a Credit Card

MINS TO READ: 10 minutes

Getting your first credit card is now part of the adulting path we all must take. These are an excellent tool for helping you to build a good credit history for future purposes and the best to manage your finances. However, even now that you are an adult, have you done your homework researching all the things you should consider before applying for your first-ever credit card? If not yet, then this guide is for you!

Have you thought about all the factors to consider, all the fees that come with it, and how to maintain a good credit score once you have your credit card? Having a such things is a significant help to your finances, but you should use it with proper caution; taking advantage of its use will make your credit score terrible and will make a massive impact on you. Think about it long and hard before you apply. Furthermore, this article is intended for you to help you be knowledgeable before taking your first step in acquiring your first credit card.

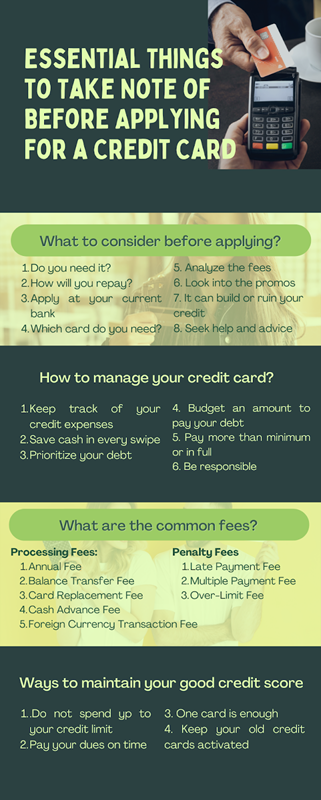

8 Tips on what to consider before applying

6 Reminders on how to manage your credit card

8 Fees to take note of when you have your credit card

4 Ways to maintain a good credit score

8 Tips on what to consider before applying

Do you even need a credit card? That’s the first question you have to ask yourself. Considering why you need it and if you can afford to pay your monthly balances is the first step in deciding whether you should or should not apply for one since having a this is a huge responsibility. Other than that, here are the other things you should consider before applying for one.

Why do you need a credit card, and where will you use it?

Financial planning plays a huge part in deciding whether you need one or not. You should ask yourself, “do I need it?”. If yes, what for? Do you need it to build a good credit score, or do you just need it to pay over expenses in case you’re short on budget? The former might be a good reason, but the latter will take you downhill.

Considering where you will use your this is essential since knowing your priorities on where you will use it will significantly affect your credit score. Also, note that these are loans with interest; you can’t use them to cover your income regularly.

How will you repay?

Planning your budget and determining if you can pay your credit card debts is crucial before getting one or charging your purchases on your credit card. Ask yourself, “can I pay this?” is the first step.

If your cash is low and the payment due date is near, you have no choice but to have a missed payment and earn a fee by paying late, which can cause your debt to rapidly stack up until you can’t pay off all your debts. Furthermore, missing your monthly payment dues can impact your credit in the future. It is advisable to calculate and estimate the amount you can spend on your credit card or use a money manager app to help determine if you can afford it or not.

Apply for a credit card at your current bank

If you already have a personal bank account, applying for one at your current bank is best. The application process might be a lot easier compared to if you apply to another bank. This may be more convenient for you if you already have your current bank’s application since you can apply for one straight from your bank’s app. Plus, it is convenient and more accessible if you pay your balance with your personal bank account.

Which credit card do you need?

Credit cards are not the same. It may offer you the same service but differs in terms of rates, fees, charges, rewards, and credit limits. If you’re not likely to use your credit card and plan to keep it just in case you need it, it’s best to apply for one that offers no to low annual fees. But, if you’re planning to use it for your purchases, you should look for a card with a higher credit limit. They may offer attractive rewards for spending but always look out for hidden fees that come with the rewards. Figure out which will suit your lifestyle and spending habit.

Analyze the rates and fees

Every credit card offers discloses all its fees and rates, which is an advantage to those seeking one with lower costs. Consider analyzing and comparing each credit card based on their fees based on the services you will be using, such as cash advance and balance transfer. While at it, it’s best to figure out which expenses can be avoidable.

Look into the promos and rewards.

Every time you’re searching for a credit card to apply for, it is inevitable that you are bombarded with all the promos, bonuses, and rewards that each one offers. However, do not be blinded by these enticing offers that can be very alluring. These perks may come with fees the bank can charge to your own. So, make sure to look out for these before applying.

Your credit card can build or ruin your credit.

A credit card can boost your credit score or turn into the opposite effect if you don’t manage your spending well. Your credit score is solely based on your credit card activities, including if you pay your monthly payments on time or if you paid them late. Making sure that you spend below your budget is an excellent choice to avoid late payments and to make sure that you still can afford to pay. Always remember to swipe smart, not hard.

Seek help and advice

For someone who’s just starting to be financially independent and learning the financial tools in the industry, it is suggested to always ask for help and advice before deciding. Many questions might be bugging you; that is why asking your friends and relatives who have experienced using a credit card won’t hurt. They might give you helpful tips as well! Listening to them will help you visualize everything you need in your application and guide you through financial mistakes that you should avoid.

6 Reminders on how to manage your credit card

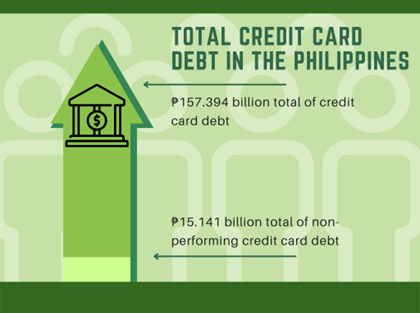

Knowing how much power this has shouldn’t be underestimated. Everyone should handle the value of each one of thesewith proper caution, or else you can be trapped in a debt hole. Credit card debt is one of the biggest problems the Filipinos are facing, said PhilStar. According to Bangko Sentral ng Pilipinas (BSP), the Philippines’ total credit card debt is ₱157.394 billion whereas ₱15.141 billion is non-performing. This amount is very alarming and shouldn’t be ignored.

This may be a practical way to purchase items and offers flexible and accessible financial management. However, you must not forget that this is technically a loan, and it requires your careful consideration, diligence, and preparations before applying for one. In regards to that, I have listed some ways you can follow to manage this wisely to avoid financial failure.

Keep track of your credit expenses

Setting an amount of your discretionary spending or your disposable income monthly and spending below its limit will help you keep track of your expenses and avoid overspending. In addition, you should be aware of all the bills you must pay in a month before spending. Make sure you can still afford to pay your expenses and still have some funds left for future emergencies.

Save cash in every swipe

Swiping to pay for your purchases can be beneficial since some offers rewards and cashback on some of your purchases. However, save cash every time you purchase something using this to ensure your monthly payments will be paid and to make you remain conscious of your spending.

Prioritize your debt

Debts might be overwhelming if you’re planning to have a lot. It might also be confusing which one you should pay first. Using the snowball method might help you pay off your debts and can be rewarding every time you pay off your debt journey. Arranging your debt from smallest to largest, disregarding its interest rate, and paying off your smallest debt first up to largest is the way to do it.

Budget an amount to pay off your debt

Following the snowball method, creating an amount you plan to pay off your debt monthly is a good start. Say you’re planning to pay an amount of ₱5,000 each month on your smallest debt. Continue this budget until you pay off your debt up to your largest debt. Also, determine all your monthly expenses before creating a budget. Disregard or cancel the services and expenses you do not need.

Pay more than your minimum or in full each month

Planning to pay off your debts is a good start. However, sometimes it might be challenging for some of us when we need the money. Paying off your monthly balances is avoidable, so ensure paying it more than your minimum to avoid earning more interest each month and show your card issuer that you’re committed to reducing your debt.

But, if you still have a budget and can still afford to pay in full, this is the best way to pay off your debts completely to avoid costly interest charges and keep your credit score right on track. It is also an effective way to control your spending and limit only how much you can afford to pay each month comfortably.

Be a responsible owner

Managing this requires discipline and self-control. Keeping track of all your spending and following all the things mentioned above can lead you to a healthy financial life. Managing your credit card is not hard if you have the will to do it. Doing so might lead to your own’s enjoyable and beneficial use.

8 Common fees to take note of when you have your credit card

Credit cards can be helpful every time you’re low on cash or in emergencies where you need the fund. However, the privilege of using this small plastic card, of course, comes with a cost. Part of being a holder is being aware of the fees and terms that go with it. Paying attention to this is a financial responsibility that you can’t neglect.

Failure to look after these fees will result in a hefty bill caused by ongoing fees added to your balance that incurs interest until it largen your debt. An example is a woman from Pampanga who is ordered to settle her credit card debt amounting to ₱3.34 million. The amount was initially ₱2.788, not until the bank added interest.

Understanding these fees and understanding them will help you manage your bills. To know more about these, I have listed all the standard fees you might encounter and how to avoid them so you can use this to your advantage.

Processing Fees

Annual Fee

The annual fee is the fee you pay for using your card and its maintenance and benefits. Every credit card offers a different amount of annual fees, which differs if you’re planning to apply for a supplementary card. Better check the yearly fee of the specific credit card you’re eyeing to. You will continue to pay your annual fee even if you don’t or rarely use your card.

To avoid paying an annual fee, it is best to go for a credit card that has no annual fee for life. If you can’t find a credit card that offers no annual fee that you want, you can at least go for a credit card that waives the annual fee for your first year. Rewards are earned on some credit cards through your purchases. To save money, you can use these reward points to redeem as your annual fee.

Balance Transfer Fee

Debts are tough to pay off, especially if they incur a high-interest rate. Transferring your credit card balance to your credit card that offers a lower interest rate will help you pay off your debt quickly and reduce the amount of interest you will be charged. However, this process requires you to pay a fee. Balance transfer fees vary in every bank as well. It is best to check on it before doing the process to see if you can afford it or not.

Card Replacement Fee

We can’t deny the possibility of losing your credit card. Either you misplaced it, or it was stolen. If one of these situations happens, it is necessary to ask for a card replacement immediately if you have to use your credit card, yet this service is paid with a fee since some processes are done before getting your new card.

To avoid spending on your card replacement fee, always be mindful of where to place your credit card. Make sure it is always in a safe place to avoid misplacing it or being stolen. If you don’t use your credit card that much, leave it in a safe place at home.

Cash Advance Fee

Being low on cash can be considered an emergency, and withdrawing money from an ATM using your credit card is one of the services your credit card can provide you. Some credit cards do not offer this service, so be mindful if you need cash. A processing fee will be charged to you when you use this service, and the amount of the fee varies on each bank.

Cash advance fees may be a bit pricey. Avoid withdrawing cash on your credit card if it is not needed, especially for non-emergencies. But, if cash is needed, consider alternatives such as a low-interest loan to avoid debt on your credit card.

Foreign Currency Transaction Fee

Traveling abroad for a vacation with your credit card is very common for Filipinos. Swiping your card in every transaction sounds easy, yet it comes with a fee. The bank will charge you on your every purchase, such as a foreign currency transaction fee, assessment fee, and even another transaction fee, all of which will be converted into Philippine pesos. Buying things abroad may sound fascinating, but be mindful of your every purchase as this may blow up your credit card bill.

You can avoid fees if you use a credit card with no foreign currency transaction fee or bring and pay using your cash when traveling outside the country.

Penalty Fees

Late Payment Fee

Paying your credit card debt on time is essential for your credit score and avoiding fees. This fee will also be added to your total balance, which will incur interest on your next due date.

Staying on top of your schedule is crucial to avoid paying this fee. If you can’t afford to pay your balance in full, try paying at least your minimum amount due. This case is more complicated if you’re handling multiple credit cards since you’re also keeping track of different payment due dates. It is better to transfer your balances to your lowest interest credit card so you can focus on dealing with only one of them.

Multiple Payment Fee

Some banks provide a limit on payment transactions within a month. Going over the limit will cost you a fee. Multiple Payment fee is not that expensive, yet this can bloat your debt if not taken with proper precaution.

Payments using your bank’s services, such as on-site, mobile banking, and ATM, are not included in this limit. If you want to avoid this charge, use your bank payment services when paying.

Over-limit Fee

You are only allowed to spend below your credit card limit, which the bank sets on your credit card based on your credit score. Exceeding your limit may cause your transaction to be declined. However, most banks charge you an over-limit fee once you exceed your credit card’s limit. But note that maxing out your credit card will impact your credit score.

Control and keep track of your spending. If you’re purchasing something that you can pay in cash, it is better just to keep your credit card in your purse rather than swiping it until you exceed. Better to monitor your spending habit to refrain this scenario from happening.

4 Ways to maintain a good credit score

You should not be over-reliant once you have your credit in your hand. Be mindful that not paying will have a significant effect on your credit history that will potentially affect you once you plan to apply for other loans. Knowing how to maintain a good credit score is good, and here’s how you do it.

Do not spend up to your credit limit.

A credit limit is set on your credit card once you have it, and spending above the limit is a big no. Ensure you spend below your monthly limit to keep your credit score stable. Limiting your spending by using only 30% of your monthly credit utilization ratio is suggested.

Pay your dues on time.

Paying your balances on time each month is very important. Your ability to borrow money and your reliability are based on how good you are with payments. The next time you take a loan, the company will calculate your credit score and see if you meet their criteria. They decide if you will be given a loan if they’re assured they will be paid on time.

One card is enough

Your credit score is also based on your credit history. If the companies see you applying for credit multiple times, this may indicate that you are greedy for credit, which is negative on their part. This will lower your credit score, and making sure you only apply for what you need will keep your credit score intact. Prioritize only what you need. This will also lessen the chances of overspending.

Keep your old credit cards activated.

I may have said that one card is enough, but there are situations where we can’t avoid applying for another one if we need it. However, if time passes and you continuously use the same card and just keep your old cards unused, it’s best if you don’t consider deactivating them if you have the budget to maintain them or pay their fees in full monthly. Having them activated will show a good credit history and more experience on your credit report, indicating you are a suitable recipient.

Keeping these pieces of information in your mind will guide your way to a better financial life, away from financial failure and falling into a debt trap. Maintaining a good credit history will surely help you when you need loans. Always keep on track, and be responsible for your spending.

READ MORE RELATED BLOGS!

READ MORE AND SHARE!

TSOK Chronicles: Unleashing Passion, Dedication, and Excellence in 2024

2023 Your Practical Wedding Guide

Investments and Finance Ultimate Guide

If you like this article please share and love my page DIARYNIGRACIA PAGE Questions, suggestions send me at diarynigracia @ gmail (dot) com

You may also follow my Instagram account featuring microliterature #microlit. For more of my artworks, visit DIARYNIGRACIA INSTAGRAM

Peace and love to you.